The Smartest Real Estate Purchase, Ever in History

Back all the way to 1867, 156 years ago, U.S. Secretary of State William H. Seward and Russian envoy Baron Edouard de Stoeckl signed the Treaty of Cession. In this, Tsar Alexander II ceded the territory of Alaska to the United States for $7.2 million dollars. In today’s dollars this is 148,714,540 USD. Let’s assume that the Consumer Price Index has been wildly wrong and the true number is 3,000,000,000 USD (more than 20X larger than the CPI values). This would still only be 1.86% of Jeff Bezos ‘reported’ net wealth–for the entire state and all of it’s resources. Just have a think about these numbers for a moment.

When the Russians sold it, it ended Russia’s 125-year ownership of Alaska and ended the Russian empire’s expansion all the way to Fort Ross, California.

Beginnings

It’s original possession came to be following Russia’s 16th expeditions eastward first conquering Siberia (interestingly, from Gengkhis Khan’s grandson). It wasn’t until Peter the Great, in the 18th century that after creating Russia’s first navy did they seek to test it out in the Pacific and cross over to what is now known as Alaska in 1741.

While the Captain died on the venture, the surviving crew repaired the ship, stacked it with furs from otters, foxes and seals and sailed back to Siberia (furs were the main commodity in all of Siberia at the time so this was deemed a success of finding such a “fur” mine).

The peak number of Russians living in Alaska at this point was only 800 which was very difficulty to communicate back to the Empire. There was no texting or email; there was send a message and after perhaps months, if they survived, it made its way back to St. Petersburg and then needed to revert back to Alaska, at which time maybe you were dead. Alaska’s northern climate was not conducive to crops so it could not sustain large settlers. Trade with Spanish settlers on California’s coast was created to mediate this back and forth to St. Petersburg, but it only lasted 30 years and the possession of Alaska did not seem like the juice was worth the squeeze.

The fur populations had been decimated, gold exploration was difficult given the frozen ground, crops were non-existent and even if they could find meat or fish they had no trading partner. Realistically, there was little reason to keep it (if you had land in rural Alaska would you keep it for trees and animals?)

After Seward defeated the Mexicans, annexed Texas, expanded up the Pacific coast of Oregon–he was pumped up and declared that the Americans would extend their people to the ice barriers to the north. Twenty years later, he made good on that desire.

What The Russians Lost

Alaska is a very strategic location as a gateway to the Arctic, proximity to Russia, Japan and China and a window into the rest of North America. A great deal of Alaska remains unexplored fully today given it’s Northern climate, thick wilderness and the fact it is 2.2X the size of Texas, not to mention all the dangerous wildlife! Besides being militarily interesting, Alaska is one of the richest states in the United States which motivated the original purchase; gold, lumber, fish and fur. The Americans were keen because they also feared that the British would seize the opportunity to be first on the scene to develop trade routes to Japan and China–something the Russians were previously unable to accomplish, but nevertheless valuable.

We now know today that Alaska is a commodity paradise. It is full of diamonds, gold, fish, lumber, furs, zinc, cobalt, silver, lead, copper but in particular, Alaska is packed with energy!

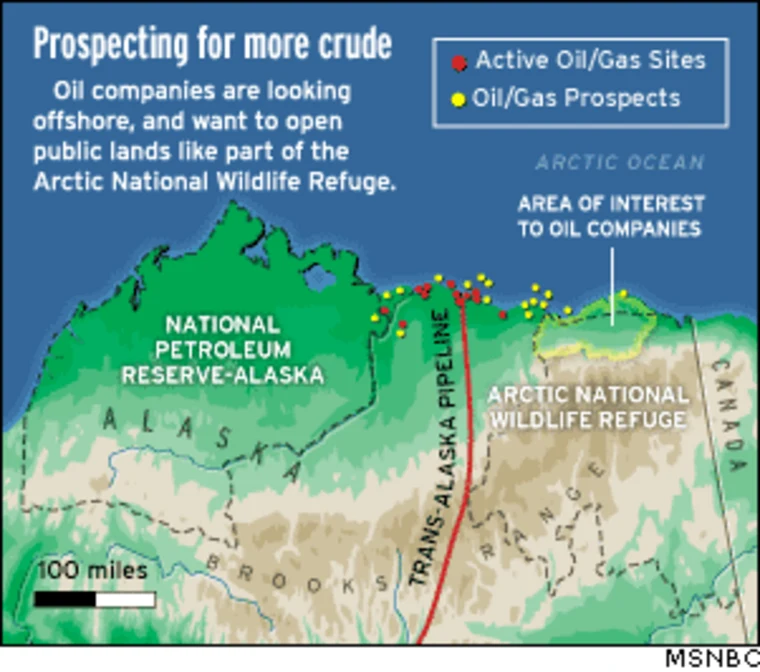

Room for expansion is amazing. Federal waters generally begin 3 miles from shore and extend up to 200 miles seaward. Eleven of 17 dividend continental shelves offshore are estimated to contain oil & gas deposits. How big you ask? A now 30-year-old assessment predicted that an amazing offshore oil/gas in Alaskas is estimated to offer an average (mean) potential for undiscovered, conventionally recoverable oil of 24 billion barrels, with a 5-percent chance of oil resources exceeding 34 billion barrels. Gas potential averages 126 trillion cubic feet, with a 5-percent chance of gas resources exceeding 230 trillion cubic feet.

For comparison, Saudi Arabians oil deposit sits at 40 billion barrels of oil making Alaska’s 58% as large. Approximately 90 percent of the undiscovered conventionally recoverable oil endowment in offshore Alaska occurs within the Chukchi shelf (13 billion barrels) and Beaufort shelf (9 billion barrels) provinces, which lie adjacent to the rich Arctic Alaska oil province. The estimated gas deposit is almost 6 times that of Qatar–the country with the highest GDP per capita in the world. Even if we assume these averages to be highly inflated, it’s still a colossal amount.

Using more recent analyses of 2020, the United States Geological Survey found, “We estimate 3.6 billion barrels of oil and 8.9 trillion cubic feet of natural gas conventional resources in Alaska’s Central North Slope. This assessment does not include discoveries made by industry between 2013 and 2017 and only evaluates the North Slope”. To outline how much potential there is in Alaska, 95% of the crude oil production comes from this one block (North Slope).

United States Energy Information Administration (US EIA) 2022 findings are somewhat more in line with the 1990 results:

“Alaska’s proved crude oil reserves—about 3.2 billion barrels at the beginning of 2022—are the fourth-largest in the nation. Alaska was among the top five oil-producing states for many years. The state moved up from sixth place in 2020 to fourth in 2021 and 2022, even though its annual oil production was the lowest in more than 45 years at 437,000 barrels per day”. This is due to warmer temperatures recently which reduce the amount of time energy companies can explore for onshore oil, because ice roads and drilling pads are used only during the coldest months of the year to mitigate damage of the heavy equipment.

As we stand today–large areas of the state remain unexplored for oil and current estimates show that the Arctic National Wildlife Refuge holds 10.4 billion barrels of crude oil. OF COURSE, the Bidenistas suspended leases on properties in 2021 and instead spent millions to study environmental impacts of oil exploration in the region (despite it continuing). They even shortened the size of the property able to be explored for oil production from over 18 million acres down to less than 12 million acres.

While crude oil reserves are far beneath the estimate mark according to the US EIA, the natural gas findings are not:

“Alaska’s proved natural gas reserves—about 100 trillion cubic feet—rank third among the states. Alaska’s natural gas withdrawals totalled nearly 3.6 trillion cubic feet in 2022, the highest since 2005 and the fourth-largest in the nation (after Texas, Pennsylvania, and Louisiana). Most of the state's gas production is not brought to market. Natural gas volumes from the North Slope far exceed local demand, and there is no pipeline to transport the natural gas to consumers in the southern part of the state–An opportunity if I ever saw one–especially when we factor in that North Slope (oil) has been producing since 1977 with output peaking in 2005. Year after year it’s becoming a little less economically because of the cold oil that is withdrawn.

Oil has become the engine to Alaska. It has funded up to 90 percent of the state’s unrestricted General Fund revenues in most years and has accounted for over $180 billion in total revenue since statehood. The oil and gas industry paid over $3.1 billion in state and local taxes and royalties in FY 2019, including $2.7 billion to the state government and $449 million to local governments. The oil industry accounts for one-quarter of Alaska jobs and about one-half of the overall economy. In other words, without oil, Alaska’s economy would be half its size. Alaska has 5 oil refineries in operation.

Again, in terms of pure real estate–> The Americans gained about 370 million acres of mostly pristine wilderness – almost a third the size of the European Union – including 220 million acres of what are now federal parks and wildlife refuges. Could you spend 148,000,000 and get that land today? I’ve only seen small islands in the Caribbean for sale for that…

We’re not the only one who noticed

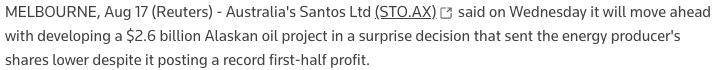

-New fields within the Arctic region, such as in the National Petroleum Reserve-Alaska (NPR-A) are already attracting attention from major energy companies. ConocoPhillips’ Willow Project and Santos’ (posted above) Pikka development are some active.

-Advances in exploration technology and the ability to access remote and challenging environments have opened new development opportunities.

-Global demand for oil and gas is strong and will remain so for decades. Alaska stands ready to help bolster domestic energy production and reduce reliance on foreign imports. Energy security and independence are crucial for any nation to realize its full potential, and developing Alaska’s resources is something valuable to the United States.

I said, Energy

Alaska not only has oil and natural gas, it has recoverable coal reserves estimated at 2.8 billion tons, about 1% of the U.S. total. Coal mines have operated in Alaska since 1855. Substantial deposits of bituminous coal, subbituminous coal, and lignite are found in the north, south, and central portions of the state, but most of Alaska's coal remains unmined. Most of this coal is used for domestic consumption with the odd shipment to Asia.

Lessons Learned

Initially, I wanted to solely focus on the potential for oil exploration and development in Alaska. While I am very excited about this prospect for the future, especially if the underlying asset increases and/or USA relations with OPEC begin to fragment, I think there’s a larger take-away from this transaction.

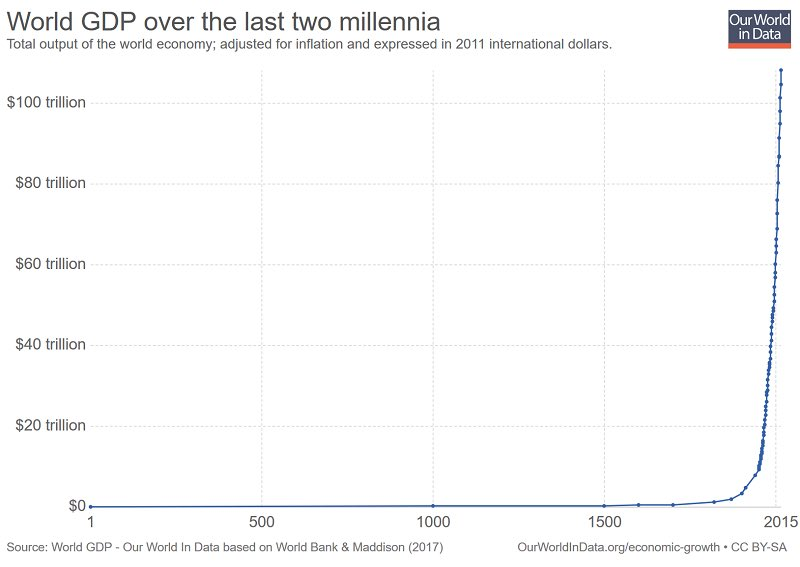

The Russians were victim of their time (see chart above). They saw little utility in Alaska due to their sole form of monetization being fur trade, the impracticality to develop infrastructure and lacked the naval capacity to establish a market of any other resource. The first modern oil well did not become a reality until 1859, far after the Russian’s main usage of the territory had been drained–and few could have seen the technological advances oil would bring almost 200 years later. These decisions were made when main sources of light were derived from grease oil lamps (from whale, vegetable or fish oil), candles stuck in animal fat, beeswax or spermaceti, log fire and any gas lighting used strictly amongst the upper class were a byproduct of coal.

Gold mining was only done with as many men who you could afford to take with pick axes & rudimentary tools. Fish trading was largely non-existent because there was no population in what’s now known as British Colombia or Yukon to trade. Timber could have been used for boats or settling but as mentioned that was not feasible. At that point, coal mining was strictly done using explosives and there likely was not enough data (or any data) to suggest coal reserves were even there (especially if their tracks in-land were limited).

Another great example is Saudi Arabia. Saudi Arabia is mostly just sand, but it wasn’t until 1938 when American’s came to drill to find the largest petroleum reserve on the planet. In both scenarios they seemingly had no options–stuck in the forest or stuck in the desert.

Closing

Alaska’s full expansion has yet to take place and I believe there is an extreme opportunity in their oil & gas sector yet to form. However, what I’m getting at is that the take away is that we are the Russians of the 1800s and there is another Alaska out there.

We can commit a seemingly minuscule allocation to a large asset that may pay enormous dividends for hundreds of years. The trick is of course having the foresight, knowledge and fortitude to take yourself and your gold coins on such an expedition. There’s going to be new technologies, new lands, new discoveries, new problems to solve and we have to be ready. As far as commodities go, if I’m on the spot and had to guess the unthinkable, I believe lithium, uranium, thorium and lunar mining would be my prediction (in order of recency). I could be extremely off (very well be indeed), but it reminds us that just like the Americans and their purchase 6 generations ago, we may be in for the best bargain deal, ever.

#StayOnTheBall for more articles on Alaska and be sure to consider subscribing or at least check out what else we have!

So are they saving it for later? Or is Washington just dumb?