If you frequent our articles chances are you’re all too familiar with the risks of holding US Treasuries, T-Bills or Notes from an inflation risk point of view. If real inflation is 7% and you’re getting paid 5% you’re losing purchasing power–simple as.

However most portfolio managers factor this in already & it’s not a deal breaker. A strong majority of them still seek to line their portfolios with T-bills and Treasuries. Why? Because they are the safest, most liquid asset there (& consequently, used the most as collateral). Collateral (& the best forms of it from a risk perspective) in many ways is the life-blood for financial institutions to obtain cash when they need it, especially during uncertain & volatile times. Knowing this, trust in it is paramount for things to run smoothly.

Migrant Crisis

You seriously have your head in the sand if you do not see the migrant crisis of Canada, UK, USA and Europe AND that it’s deliberate. Three letter organizations are actively facilitating & funding the economic migrants illegally entering countries’ borders all over the developed world–with no end in sight.

In the subscription service, we explain our 4 predictions on what’s behind the concerted effort to bring the 3rd worlders to the 1st world–however admittedly there’s one factor that we hadn’t mentioned. Votes.

Many videos elude that all these illegals are uniformly going to vote for the Bidenistas since their policy is to explicit protect illegal behaviour; whereas Trump’s is at minimum, uphold the law as best as possible. I rejected the notion that all this could be about votes (it surely isn’t in Europe), but after seeing the strong pro-Biden support where little exists by Americans themselves and the sheer number of invaders–there may be something to it.

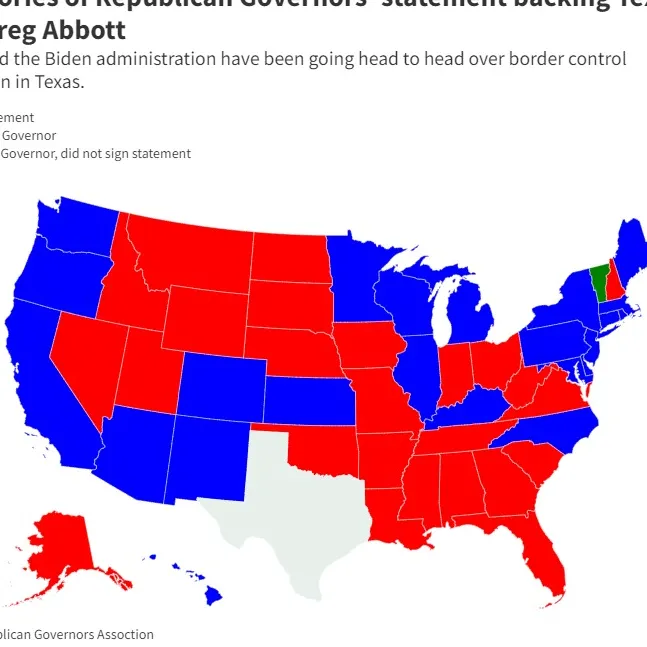

In the red, you see the number of states that are actively supporting Texas (even by sending military personnel to Texas) in effort to secure the border and enforce legal immigration policy. The country as you can see, is quite divided on the matter, it just so happens by “red” and “blue” states; the former wanting the “voters” to go away and the latter wanting the “voters” to come on in to register for ol’ Joe.

Again, if you refer to our subscription, you’ll see that I argue that all states are “in on” the mass migration for various collective purposes and this is likely more political theatre–but if the explanation behind the migrants are to fix another election than this is a matter that would quite literally divide the country in two. Power is on the line for both the Republicans and Democrats. With the machines they have, maybe all they need is 5,000,000 people to vote one way or another to change the tide.

Okay So What

In the event that this already chaotic situation were to spin out of control, Washington, with support from London, Australia and Brussels would likely place considerable effort against Texas and those states who supported against their migrant policies. As a “get in line” technique, you could expect many threats to come from the top to influence policy switching their way. One such threats, could be using the treasury markets.

If we look at the treasuries held by state and local governments in June 2020 (latest data) you see there’s two columns of 834.7+347.2= 1181.9 Billion (1.18 Trillion) dollars.

The US offers two main types of debt: public and intragovernmental. Public debt is sold as Treasury bonds, bills, and notes to outside investors, including foreign governments. It funds various government activities and pays off older debts. Intragovernmental debt, on the other hand, is what the government owes to its own programs, like Social Security, Medicare, retirement funds, and more.

In the unlikely, but growing possibility that the country begins to fracture politically ahead of this election, it’s feasible to consider that Washington may threaten to not honour their treasury payments and/or liability payments to these individual states to force them to get in line. The key (& I stress this) is that Janet Yellen doesn’t actually have to default on these payments to the state governments, she just needs the threat of it… but this could be enough to crush confidence in this form of collateral for money managers. After all, why would you hold collateral (because why would anybody else want it either) that has such political risk of de-facto default attached to it

While you think this is crazy, they already have a blunder by weaponizing the USA dollar on the global scale. The most recent is on the freezing of Russian treasuries where they did default on paying Russia the coupon they were owed (did you hear about that?). As a result, Saudi Arabia, Japan, China, UAE, Brazil are all unloading US Treasuries. In fact, if you sum the holdings around the world by foreign governments, they have fallen in just the last couple of years. Additionally, there are now serious talks considering not only the freezing but the seizing of the Russian debt assets as a means to continually fund the Ukraine war. In other words, the US government would seize Russian assets to use it against them. It doesn’t matter how “Pro-Zelensky” you are, this action would undoubtedly kill the debt markets, forever. Of course leave it to government to spend hundreds of billions a on meaningless border war and then seek the advantages of saving a few billion by defaulting on a payment to Russia.

Closing

As this continues to spiral out of control, it’s hard to predict what the plan is (or even if they have a plan) (PREDICT THE FUTURE WITH OUR FREE TOL BRIDGE), but if these migrants (among almost every other matter) are a sincere political matter as opposed to just more political distraction, than one must entertain the possibility that debt markets will be a used as a weapon of war. After all, if they used it against Russia and those in the Middle East, what’s the big deal if we mess with Utah a little bit? That’s the psychological make up of the statists in Washington D.C. at the moment.

Everything revolves around confidence and trust in counter-parties and if that trust is lost–it’s extremely difficult to earn it back. You know it, too bad the government doesn’t.

…And you wonder why I’m buying all the gold I can get!

Thank you for reading and please share if you think it is a far-fetched but nevertheless entertaining read!

#StayOnTheBall