New Hope Group is an Australian coal producer with associated coal port, oil and gas, and agricultural operations

Company Details; Operations

Founded in 1952

With over 900 employees

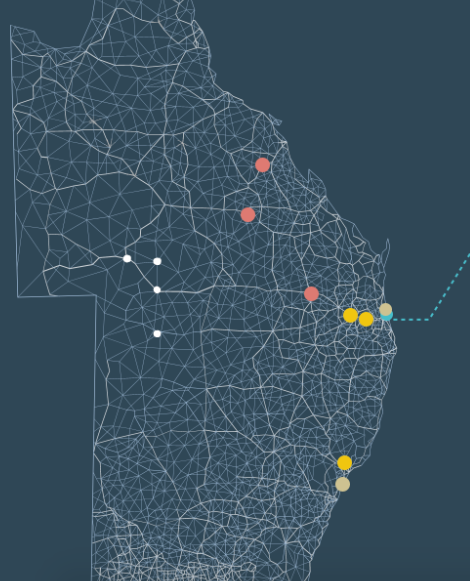

New Hope currently has two open cut coal mines, one in the Darling Downs and one in the Hunter Valley: New Acland, north of Oakey in Queensland, and Bengalla, west of Newcastle in New South Wales.

The Company also has three previous operations that are currently undergoing rehabilitation in the West Moreton region – Jeebropilly, New Oakleigh and Chuwar.

Bengalla is their main operation. Bengalla is an open-pit mine where New Hope receives 80% via a Joint Venture. It operates 24/7 using dragline, truck & excavator methods of extraction. Life of the mine is expected to run till 2039.

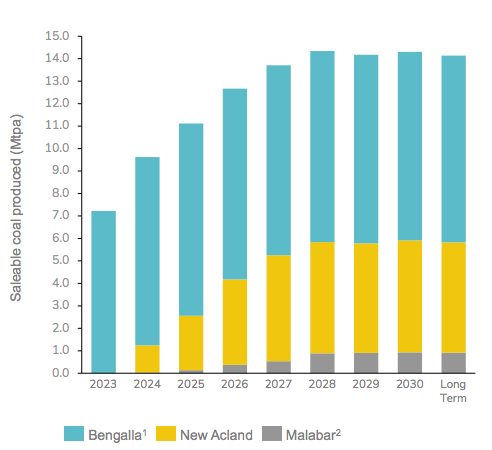

New Acland is also open-pit with operations since 2002. However, as of September 2, 2019, the mine has become postponed due to extension applications being denied. Stage 3 has been challenged and delayed by the Oakey Coal Action Alliance continually since 2012. Although interestingly, late 2023 is the year that they’ve seen their first sales from New Acland Stage 3 legal disputes resolved. They are ramping up to deliver 5.0Mt per year by 2027 financial year. The mine has potential of having operations continue till 2049 with an estimated $1B AUD put into operations during this time period.

A long with the three properties also seeking rehabilitation, New Hope owns a bulk processing facility for an array of exports that has been going strong for 3-decades (Queensland Bulk Handling).

Oil

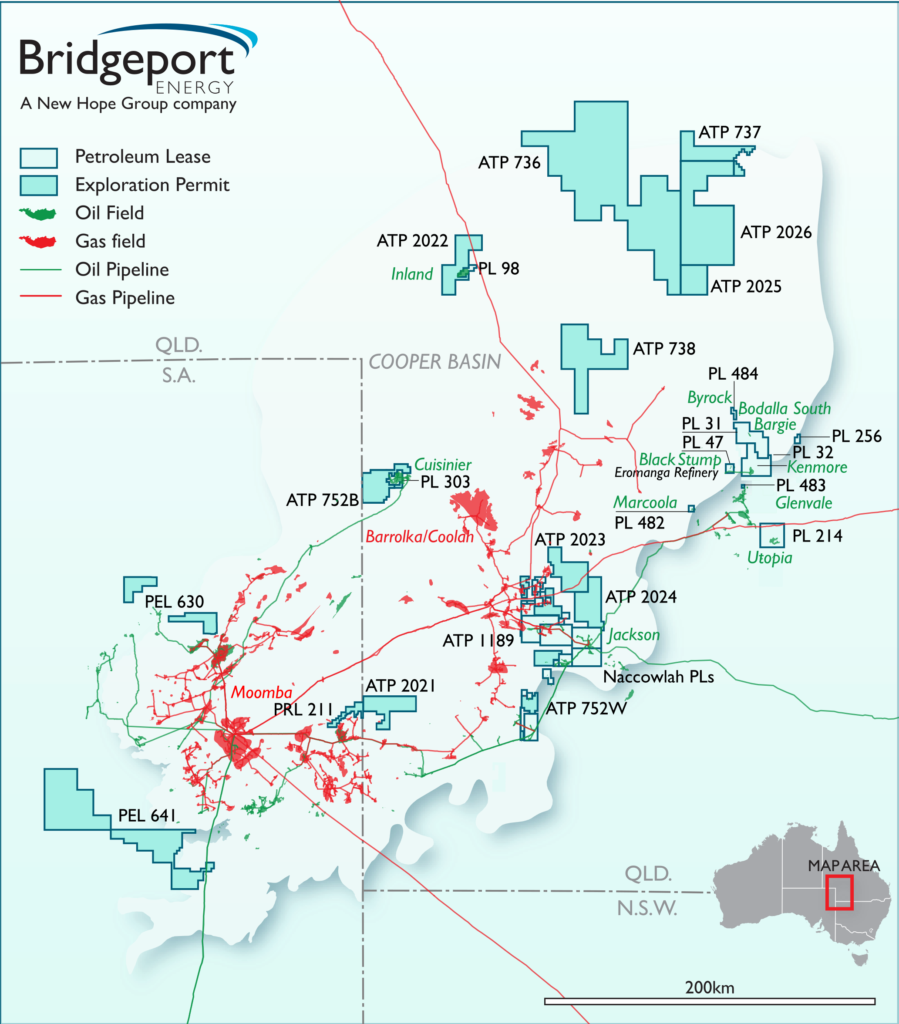

New Hope also owns 100% of a subsidiary called Bridgeport Energy Limited which is diversified into many oil & gas deposits. It’s goal is developing reserves and increasing production through focussed technical analysis of its producing assets with the application of modern seismic, drilling and completion practices. At the present time, the Company’s oil fields are producing a total of approximately 1,100 bopd–a small amount, yet they have lots of prospective properties with permits in place. Bridgeport itself could be a whole new post–look at their resources below:

- Bridgeport holds 849 km² of net oil producing acreage in nine production projects, located in the Cooper-Eromanga Basin

- Bridgeport also owns a facility capable of storing up to 3,000 barrels of oil

- PL 98: Inland Oil Field – 40 km² total, 100% interest

- PL 214: Utopia Oil Field – 220 km² total, 100% interest

- PL 303: Cuisinier Oil Field – 76 km² total, 15% interest

- ATP 1189N: Jackson / Naccowlah Area – 1,960 km² total, 2% interest

- ATP 2021: Vali – 370 km2 total, 25% interest

- ATP 752: Barta / Wompi Blocks – 472 km² total, 15% / 17.5% interest

- PRL 211: Odin – 99 km2, 21.25% interest

- ATP 2022: Morney – 441 km2 total, 100% interest

- ATP 2025, ATP 2026, ATP 736, ATP 737, & ATP 738: 8,497 km2 total, 25% interest (each)

- PEL 630: Playford – 393 km² total, 50% interest

- PEL 641: Maslins – 1,954 km2, 100% interest

- PL 1: Moonie Oil Field – 201 km² total, 100% interest

- PL 15: Boxleigh – 259 km2, 25% interest

- ATP 608 / PCA 156: Rookwood – 153 km2 total, 100% interest

- ATP 805 / PCA 161: Donga – 152 km² total, 100% interest

- PEP 150: Digby – 3,210 km² total, 50% interest

- PEP 151: Arkarua – 858 km² total, 100% interest

- VIC / P007191 (V): Bonanza – 439 km2 total, 100% interest

Additionally, this year (2024), New Hope’s subsidiary acquired Assessment Lease (AL19) which covers an area of approximately 8,100 hectares to the west of Muswellbrook in New South Wales for exploration. They have also made a strategic 15% Equity Investment held in Malabar Resources Limited. Flagship asset is the

Maxwell Mine that has begun producing semi-soft coking coal this year as well.

Agricultural lands are also part of their company. The Acland Pastoral Company (APC) oversees 10,000 hectares of land, including grazing 2,000 head of cattle, and manages 2,400 hectares of crops on land that has been used for coal mining year prior.

They export Tivoli brand coal, which produces low nitrous oxides and carbon dioxide emissions and has low sulphur content, making it one of Australia’s cleanest burning coals. Australia accounts for a significant amount of high-caloric (>6,000 kcal) coal worldwide (64% excluding Russia).

Ticker: New Hope Group (NHC.ASX)

Ratios

P/E: 4.06

P/B: 1.78

P/S: 1.63

Book Value/Share: 3

Enterprise value / EBITDA: 2.2X (predicted 4.02 this year).

Earnings Yield: 22.98% (2023)

Market Cap: 4.03B AUD

Debt-to-EBITDA: 0.08

Cash-to-Debt: 5.62

11.3% Dividend Yield

Performance

Analysts at the time of writing are favouring it to have more downside than upside, although the agreed upon Moat is stable–but from what I can tell, the same are bullish on Nvidia now…

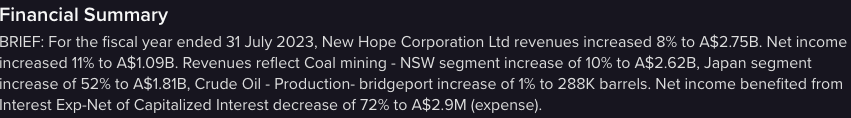

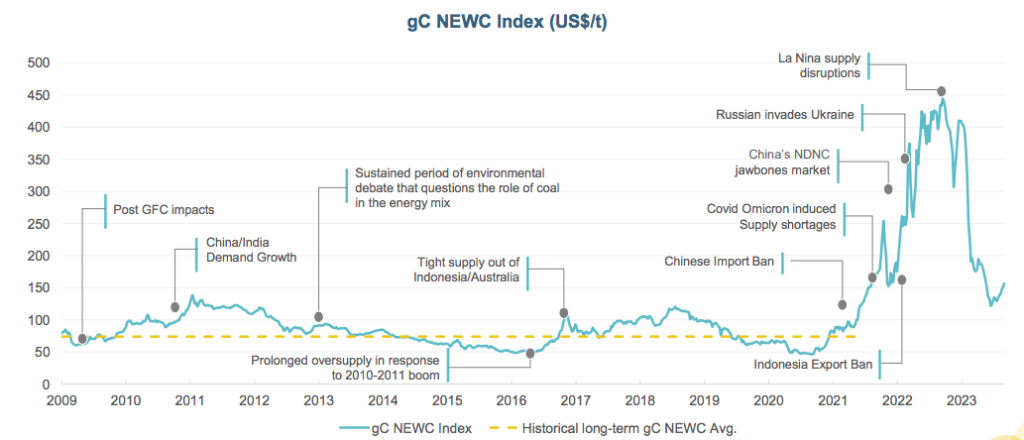

7.6Mt of coal was sold in 2023, a 14% decrease amid contractions from China. Of this sold, their average price was $346.73/t AUD–which is well above averages for Newcastle prices.

Supply shortages to come amid a contracting shipping routes with issues at the Panama and Suez Canal could see another threshold event for coal markets, rebounding prices for New Hope.

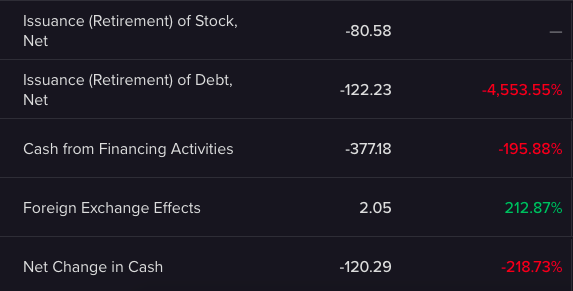

They have been paying down debt considerably in this meantime while coal prices have fallen (but are still making money in the meantime).

Valuation Demo

The 11.3% result assumes a fair 7.5% discount with a large contraction in growth from 2027 to 2031 which seems overestimated given their aggressive expansion of investments/projects & potential for free cash flow from other operators.

Altman Z Score: 6.91 (Safe territory)

Cash Flow

As of July 2023 (Annual performance)

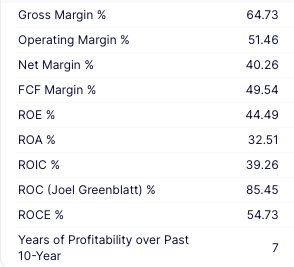

EBITDA showed a 40% increase.

It is important to note that these net operating cash flows (1.52B) was following a 21% increase in site cash costs, a 33% increase due to inflationary pressures and a stated 67% temporary cash cost increase.

$839M were paid in dividends, a large 172% increase YoY. Of cash flow from operations, the company had 12.5% on market buy backs (192M). The average price of the buybacks were $5.19AUD (11.6% above current trading price).

Operating performance did contract 20% for Q4 2023, but for the same quarter, retirement of debt has been huge.

What happens when they have no more current liabilities to reasonably pay down & the oil/gas properties begin producing–they’re going to be cash flow machines. 3-Year FCF Growth Rate is already at 104.3%

As of January 2nd this year, they are sitting on over 730 Million Australian Dollars in the bank. Of which, 1.11B are current assets.

This cash in the bank equals 16.5% of their current market cap. Additionally, 207.5 Million AUD are in accounts receivable while accounts payable only sit ~95.2 Million AUD.

Strong points

- Currently debt free.

- Dividends are covered by earnings and cash flows. Moreover, their New Acland coal source is 459M over three years also covered by operational cash flows. This is done using existing infrastructure & supply chains.

- Dividend is in the top 25% of dividend payers in the market; a goal is to sustain the dividend.

- 16-year long legal dispute over Stage 3 has been resolved with an expectation of nearly 1M tonnes of coal produced this year already. (+) $200 million investment funded through operating cash flows over 2023 – 2026 financial year for Bengalla.

- Future upside by rehabilitating prior operations + massive oil & gas assets to that have yet to be fully tapped into at all to de-risk their balance sheet.

- Disciplined allocation of capital leading to TSR of 21.83% annualized performance (compared to all ordinaries ASX markets of 8.83%); the amazing part is that if you bought during launch in 2003 and reinvested the dividends, you’d be up 4977% (11X the ordinary Australian market).

Ownership

53.83% by Institutions

1.68% by Strategic Entities

44.49% by Others (Retail)

The trend is Others are selling off while the institutions are upping their allocation.

Non-executive directors and the Chairman have been buying shares themselves for the last 12-24 months in quite large sums–there is no record of any of them selling during this period.

| Shares Outstanding: 845.34 |

Check out the article on a stock to short here where I do the same Bulls vs. Bear argument

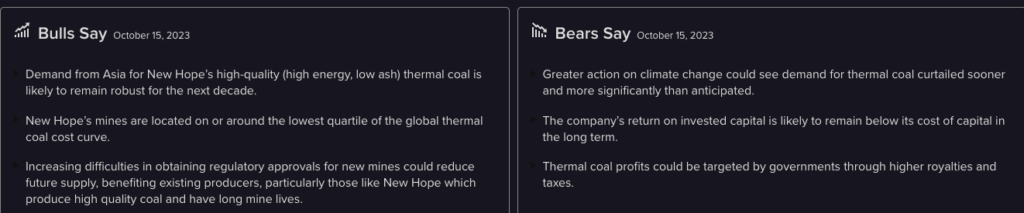

“Action on Climate change” is a purely political dogma which bears no resemblance to the free market economy. Politicians can play make-believe with their politics only so long because having a secure energy source, which is to say a domestic economy, is far more important for the politicians to securing political power. The CEO recently has said “It [coal] keeps the lights on during the energy transition”. In my opinion, there won’t be any energy transition, but everybody will want the lights to remain on forever. Even if we play this game, New Hope is one the cleanest of the coal producers in the country & their agricultural use-case for operations is another “ESG” win on their side.

On the second point, I don’t doubt that this is a weak point given the cost of capital in markets–however, as I’ve shown with the aggressiveness on paying down debts and already high net income margins (not including any rise in coal prices), that this will not be enough to damage the stability of the company. This is a trend found in all of energy markets, where it’s simply not profitable to continue to reinvest capital into energy operations which has a constriction on supply production (as written in the bull side) and companies are electing to pay out quite large dividends to shareholders instead. Again, even if we play this game of “ROIC is terrible; it’s un-investable”, their new on-air Stage 3 mine is expected to cost a low capital investment of $459m over three financial years funded purely by operational cash flows.

This company is sitting on over 700M of cash in the bank. I believe they will plan to expand their infrastructure & exploration for more oil & gas deposits from their Bridgeport assets but again at reasonable costs.

On the last Bear point, there’s no doubt in my mind that government regulation can be a threat & will eat into profits. Check my article on the Great Extortion. Currently income taxes amount around 28.5% for New Hope. However, given it’s cruciality for the global economy, it doesn’t make sense to destroy their coal industry entirely AND all oil & gas operations–especially as perhaps more are waking up to the sham of globalized, “woke” politics as previously mentioned.

Closing

If we divide up the world between West & East, Australia is one of the only energy powerhouses that are on Team West but remain in an interesting position as Asian countries nearby wish to fuel their economy with coal purchases from them. In fact, their outlook is that developing countries in Southeast Asia will become their primary customers. Additionally, Australia’s low debt position is mirrored by many of their largest corporations which have been paying down debt, paying larger and larger dividends and sitting on the extra cash prudently. New Hope Corporation is one of these companies.

Many investors are scared by the prospect of coal but I think coal will look something like tobacco stocks during the 80s and 90s (see figure under Strong Points). Navigating all the regulations and non-sense coming their way but still managing to return huge sums to their shareholders a long the way and continuing to pump out steady revenue increases resembles the tobacco companies decades ago. Their latest corporate presentation reads “net zero by 2050 is becoming increasingly difficult”. They’ve done their maths, they know it’s a sham and that’s why the insiders are buying consistently for the long-run. As it becomes more apparent of how many countries are energy dependent, I believe the ideological “die trying to save the planet” will go by the way side when economies are feeling the pain–coal, while still a major player is not going away anytime soon.

In addition to their current low-cost operations with coal, New Hope has exploration upside potential as well as increasing exposure to oil through their Bridgeport subsidiary & agriculture greatly de-risking operations to give them breathing room to play with their numerous assets. Even if they do not bring other coal assets back online they are still producing free cash flow with current coal operations & can seek to liquify them to sure up their balance sheet even further. It’s worth noting that their bulk handling facility is a great asset with the ability to load 48,000t per day (depending on product characteristics). Sure, liquid natural gas may be nicer, but transporting it is much more difficult–coal, you simply throw it on a ship & off you go.

However it plays out with their numerous assets & regulatory problems that appear, they pay a nice dividend in the meantime as they sit on their large cash position with healthy valuations & hungry customers nearby. It’s not sexy like mining for bitcoin or coating mother nature with solar panels, but I’m hopeful that it fits in most portfolios with a long-term outlook.

Thank you for taking the time to read, if you enjoyed this please take the time to share & follow us on Twitter!

Also, if you enjoy this, consider subscribing and if not, stay up to date with our posts by getting our biweekly newsletter!

#StayOnTheBall