Bermuda Isn’t Worth It

No this is not about the Bermuda Triangle…

Bermuda is an absolutely beautiful, classy, clean, safe British Overseas Territory in the middle of the Atlantic Ocean. It really is the epitome of being rich. My parents spent their honeymoon there and they may still be paying it off.

But things are changing. Beyond the huge insurance companies and shipping companies domiciled there, Bermuda is crossing a line in its pink sand as being the most attractive offshore destination to reside, work or even travel. Here are large reasons why I believe the island is losing its allure

Number 1 in…

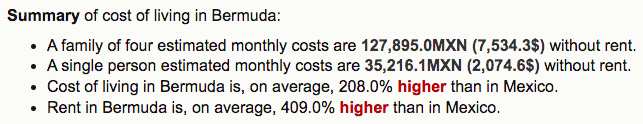

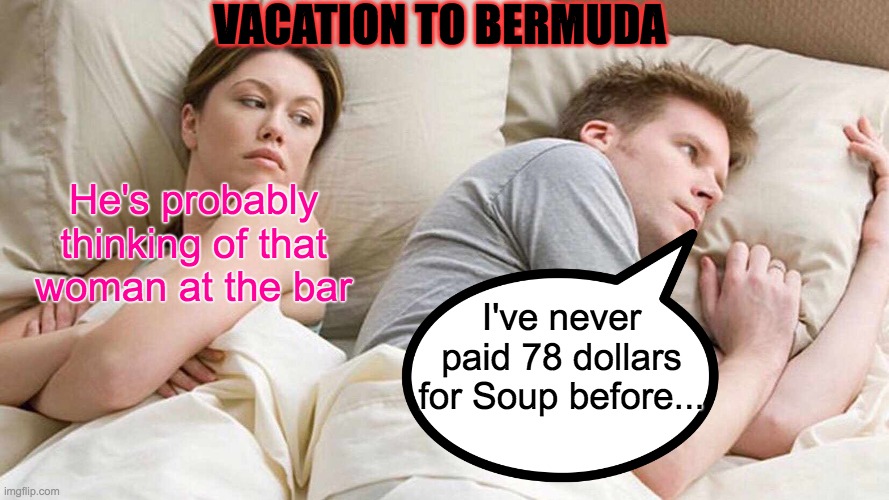

Bermuda continually ranks as the most expensive country on the planet to live. Read that again. That beats Monaco, USA, Switzerland, Norway, Singapore, Jersey (UK), Australia, Cayman Islands and others. To give you a sense of how large prices really are…Bermuda costs of living are 310% more those of the USA, 280% more than in Canada and 220% more than in the UK. Numbers on rental cost, scooter rentals, drinks, boat rentals per month are approximately the same (about 3-4X that of Canada, USA).

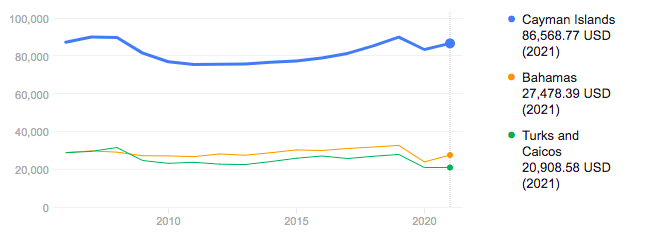

For 2023, Switzerland, often celebrated for its quality of life, has been ranked second on the list. The country’s strong economy, high wages, and top-notch healthcare and education systems come at a premium. Cayman Islands, another pinnacle of finance, freedom, low tax and wealth came third. The Bahamas, Iceland, Singapore, and Barbados also made the top ten, with Norway, Denmark and Australia coming last in the top 10. Bermuda has yet to be dethroned as number one.

Housing

Want a dream house? You can keep dreaming for one… In 2020, 42% of the internationally available homes were bought by Bermudians at an average price of $4,500,000, an increase from $3,365,000 a year prior. The notable increase of 34% in the average price was universal in Bermuda with the highest for the year being $11,000,000.

Even if you’re lucky enough to afford such a house–why keep it? Effective 1 July 2019, the progressive scale of tax rates ranges between 0.80% and 55.00% based on the ARV of the unit for PROPERTY TAX. The land tax on commercial properties is 9.5%, which is effective with respect to commercial properties from 1 July 2019. For tourist properties, the tax rate is 8.9%. Some high-end villas cost 80,000 dollars per year just to hold. Compared to St Barts (no property tax), areas of posh London (far lower), Cayman Islands (no property tax), Monaco (no property tax), Dubai (4%), this is very high.

On the island you’ll also find that most monthly rental agreements will stipulate that tenants, not landlords, are responsible for all periodic internal painting and upkeep but landlords will do external maintenance. Parking may be additionally as well. I suppose landlords need some help to fund these costs somehow.

These numbers are largely not considering the very recent increases in cost of living following the unnecessary measures taken during the whole Covid madness.

Didn’t hear about it? I don’t blame you

In Bermuda, there is no official Cost of Living Index provided by the Bermuda Government. The Consumer Price Index (CPI) program is the closest thing, which often can have its modelled tweaked to satisfy the listeners & paint a different picture.

Local economist Robert Stubbs, whose research suggests “uncompetitive practices” are widespread in Bermuda today. His research notes to four sectors — electricity and water, motor vehicles sales, retail and transport — where competition does not appear. In other words, a monopoly exists. In these sectors, he noted that while total employment income had fallen between 2009 and 2016, business profits climbed sharply. Mr Stubbs cautioned that the island’s pricing problems are structural and go beyond what a competitive markets authority could resolve.

Household spending data from 1974 to that of 2013, reveals that housing, healthcare, entertainment, education have all increased their shares of Bermuda’s household expenditure over that four-decade period. Mr Stubbs, who used to work as head of research at Bank of Bermuda, has produced several insights into the local economy. Among his conclusions are that 23 per cent of the island’s population live in poverty and that Bermuda has suffered from an overemphasis on financial services in recent decades. It’s money in, money out, with very little to spare at the end of the day for the locals who reside there. Of course, all of this is hush-hush with Bermuda given the magnitude of the problems.

As evidence, In 2019 the current government party in office claimed that people were beginning to leave the island altogether due to the narco activity pushing them to find safer places (Which is quite stupid given how safe the territory is…) The opposition party at that time responded “No, it’s because people can no longer afford to live here”.

Interestingly, this is not selective for just locals who live on the island, but also those looking to visit as a tourist or work–again, not in the brochure. Newcomers need to be forewarned, to enable them to negotiate more accurately with a prospective Bermuda employer for a realistic starting salary and benefits package. If you are considering a job offer, you should know that I’ve seen some people calculate that if you’re not earning 130,000-250,000 Bermudan Dollars (1:1 USD) than you won’t cut it (160,000 was calculated showing a conservative, unexciting lifestyle).

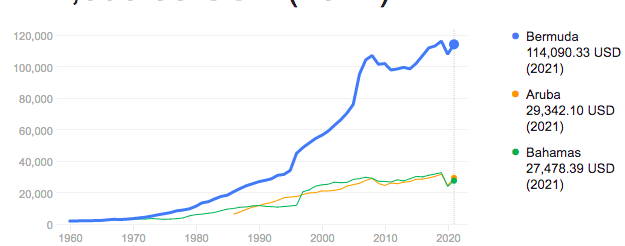

Compared to the rest of the Caribbean, the GDP per capita of Bermuda went hyperbolic, but cost of living prices have more than compensated.

Government Intervention

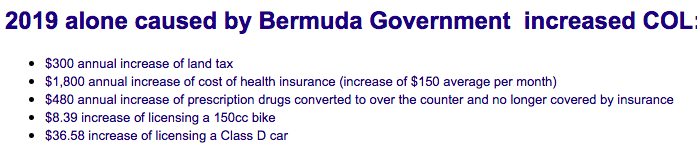

Being a British Overseas Territory and a powerhouse for large corporations, shipping and insurance companies for it’s zero corporate tax rates, it often gets thrown into the category of being pro-freedom, pro-business, small government, etc. In other words, a sort of libertarian paradise–but this is actually not that true, nor is it trending in this direction at all. Below are some findings that explain the high cost of living:

- Massive Bermuda government customs duties average 36% or more of retail value on practically everything including all foods and fuels, a significant food tax on all items made with sugar, more than 12% on the price of bread and pasta and related products and more than 7% on meat, fish, fruit and vegetables. Bermuda Government import duties are the government’s second-highest source of revenue & there’s no sign of altering these revenue streams.

Want to escape this? Way back in 2017 Senators agreed that importers of food and other goods should face fines of up to $5,000 if they fail to provide information to a new commission to look at their import costs and profit margins–a crackdown. - Mobile phone fees and the government authorization fee on the telecommunications industry increased

- Taxes on taxi drivers have been difficult to collect, so to compensate, they issued a $1000BD fee on all drivers–which raised the prices for people using cabs to get around.

- According to Bermuda corporate law, local companies are legally required under Bermuda law to control the majority of local consumer marketplace. The ruling has required Bermudians to have at least a 60% controlling interest in the owners, directors, administrators or managers, financial controllers and other officers and staff of any company or entity that is not an exempted company and conducts any form of business in the Bermuda marketplace (there are exceptions of course, but with a population of only 64K, there’s only so many qualified, willing business partners)

- Bermuda introduced a sugar tax. The scope of this is quite broad as it relates to a food product containing sugar at all. New Legislation also increased the cost to import alcohol and tobacco. The Customs Tariff Amendment (No 2) Act increases the cost of duty for a variety of alcohol and tobacco products–this had an overnight impact for consumers.

- Back in 2019, in an extraordinary, arbitrary government announcement, there was financial increases in how medical care will be administered in Bermuda.

- The Bermuda Government has a huge number, easily the highest in the world per capita, of elected members of Parliament, 36 in a total land area of only 21 square miles. They and their ensuing political baggage cost the local taxpayer hugely more per capita than in all other countries.

- The Bermuda Government is Bermuda’s biggest employer by a very wide margin. Bermuda has the highest number of civil servants in the world (per capita) and is the single biggest contributor by an equally large margin to Bermuda’s cost of living being the highest in the world for residents, business visitors, retirees, senior citizens and tourists by air and cruise ship.

- A few years ago, a pre-budget report stated that that new taxes were to be included on homes where the main function was for rental to tourists or to employees in international business. Other proposals included a 5 per cent general services tax on goods and services and a 7.5 per cent tax on professional services. A year later, a new specific tax on banks and insurance companies was in place as well (adding millions to the government).

- Bermuda produces almost no foodstuffs or other consumer goods and is completely reliant on food being shipped in, mostly from the USA on a weekly basis. One of the few things that isn’t imported is the carrot. The government is diligently strict for policing the shippings to and off the island.

I hope my list here was a bit excessive and exhausted to highlight the point that nearly ever facet of life in Bermuda is subject to taxation and the government is striving faster than ever to line the coffers. If you feel tired reading this, imagine having to pay it everyday like the locals– Everything has an added cost to it because of government intervention.

This year, proposals to increase revenues via significant changes to the current employment tax regime were put forward as well. Increases in the employer portion of payroll tax for exempted companies from 10.25% to 10.75%. This is the first time that Bermuda’s exempted companies have been required to pay a different payroll tax rate than local companies. A reduction is seen in those who make 48,000 BD or less (few on the island), whereas all of the other income bands would see an increase, with the top rate – payable on annual remuneration of over $235,000 – going up significantly, from 9.5% to 13%. Payroll taxes heavily impact on labor-intensive industries, further damaging productivity on the island which leads to more imports and thus, more import duties.

Being a zero tax country, the state has always relied on import tariffs to fund itself (which is actually how all countries operated back in the day and it was plenty of tax revenue); but as you can see, they have gotten particularly aggressive and this is dramatically raising costs for the locals.

Want something to say but don’t want your name posted on the internet? Use a writing name and post with us

Write Anonymously

Corporate Situation

Bermuda has been changing their competitiveness in the offshore sphere as well for the sake of their overlords. They’ve joined the party with the Economic Substance requirements whereby “relevant sectors” (basically areas that are lucrative) require you to have substance (hire locals, have offices, bank, generate income from there) on this overpriced island. For small pockets of even a few million, this is a death sentence; it only appeals to the big money who can afford to set up big operations. In my experience of dealing with corporate service providers with these islands, Cayman and British Virgin Islands are a lot more flexible and open than Bermuda who took a more strict implementation of these rulings. Of course, the former two are far cheaper in operating exempted companies as well. The fees associated with registered agents will cost you more than other zero tax countries

Perhaps the most notable change however is the introduction of a corporate income tax of 15%. As I write this, they are working out the details with respect to new legal definitions, sources of income, categories of operation, accounting and much more legal jargon–but it’s meant to be aimed for multinational companies and who have an annual revenue of 750M euros a year or more on the island. The corporate income tax is expected to be enacted prior to 31 December 2023 and be effective for tax years beginning on or after 1 January 2025. The consideration of a Bermuda corporate income tax has significant implications for multinational groups, more specifically for insurance and reinsurance groups with a significant presence in Bermuda.

The government aims to offer many reductions, incentives and tax credits to offset the introduction of a new tax. More taxing–and I believe it’s only a matter of time until this becomes applicable to all.

Would I want a Bermuda company/LLC? Of course, it’s still very attractive–suffice to say I don’t have 750M a year. However, I can say that about many other jurisdictions and it’s questionable if the costs justify Bermuda being the ideal location.

A 51st State

Many will say “Oh your full of shit, this is a plus”. Indeed, the connections to hubs like New York and Florida for businessmen is quite ideal–for Americans. Without travelling through the United States, I believe London is your only other air travel option to arrive to the island. I was looking to get to Bermuda during the whole Covid charade but I was unable to because of my layover flight to the USA. I understand the romance of being isolated during another large international event–but on the most expensive island & dependant on imports? Hmm…

USA exercise lots of control and monitor Bermudan politics quite close–which can be against someone who is wanting to “break free” from Washington’s grip. Unfortunately, this pretty much is how it goes for these small island territories & countries.

Weather Events

Nope. It’s still not about the Bermuda Triangle–but its worth mention that being in the middle of the Atlantic Ocean has it’s problems. Yes, it has a favourable climate and amazing beaches to spend on year round but having said that, it’s not as hot as many people believe. They are perfectly positioned for hurricanes and nasty weather events at least once a year.

To my knowledge, to obtain residency (recently amended so a 5 year wait is no longer necessary) on the island (beyond a 1-year certificate) it’s necessary to invest 2,500,000 dollars; which is often in real estate. This has been wildly successful where since 2021 total associated investment amounted to $371.6 million. This investment includes $113.4 million in real estate investment. However I have to ask–if you had $2.5M or more, aren’t there better places that don’t get hit by hurricanes?

I can tell you from a residency perspective, (in terms of how many second or third residencies or passports you could get) it’s absolutely a waste.

Contact us to discuss or ask questions!

Other Thoughts

Bermuda had recently registered their 4th murder of the year before year close (that was reported) which is surely smaller than what you’re used to but you must remember this is against a population of less than 64,000 people. This comes at a time when the Caribbean truly is undergoing an epidemic of crime ranging from gun crimes, drug smuggling, murders, kidnapping and new cyber scam crimes. It’s unlikely that Bermuda will face the same crime rates as Saint Lucia or Jamaica anytime soon–but again I believe in a challenging macroeconomic environment it’s cause for concern that crime rates could worsen against a tremendous price tag.

Given that insurance is a main pillar of the Bermudan society–it could be an issue for them in a climate of higher interest rates. Finance. Insurance. Real Estate. (FIRE) typically suffers during higher interest rates, so there’s cause for concern that they may encounter some layoffs in the future.

Bermuda has competitors–areas of Mexico definitely offers luxury (for a far cheaper price), St Barths has become more popular as of the last 5-10 years, Cayman, Bahamas and BVIs offer an alternative, Italy while faced with more than a handful of problems still has much to offer with a lump tax program (Switzerland & Gibraltar also have lump sum tax programs), Seychelles has remained the only 1st world country in Africa with still improving numbers with amazing views & privacy, the Persian Gulf countries have experienced tremendous development within the last decade as well. Even Fiji (the country with the military coups not long ago) has become a billionaire hang out recently. The point is that the main benefits of Bermuda are not unique to Bermuda any longer.

Closing

Bermuda is no doubt a spectacular place. It’s beautiful, luxurious, clean, safe, prestigious and still boasts immense wealth and numerous company entities. It’s legal system is robust and it sets a standard in the offshore world.

The reality is that Bermuda is not the only place with these traits in the world. When you begin to go offshore shopping and size up food, rent, land, tax, entertainment, electricity, utilities, goods, company structures, legal costs & much more–it simply doesn’t justify spending extra. Your options are already amazing and plentiful if Bermuda is on your list–and quite frankly, better elsewhere. If you’re extremely wealthy, the only justification for eating these excessive costs (relative to the other expensive options you have) is simply enjoying Bermuda a little more than the others–millions more though?

The trend is negative for this territory and I don’t see anyone discussing this point. It’s government is playing a larger role by intervening in economic affairs, raising taxes/fees and becoming increasingly a centralized economy concentrated to those with immensely deep pockets.

Admittedly, I’m not the sort of person who can buy a 7,000,000 villa and reside there 12 months of the year. Although, if I did have that sort of wealth, I have to say that it still doesn’t make sense to live there–not when you consider the other options available that offer far more resiliency in terms of food, energy and transport.

Given their location, they are *mostly* connected by two politically charged countries in the USA & UK and therefore dependent on them. Its lack of domestic production of energy or food makes me question their ability to stomach rainy days in the global economy.

Contact Open Door Consultancy for affordable assistance in relocating & to see if you have a claim of Citizenship By Descent, today!

Once you go beyond the up front corporate income or withholding tax figure, the trend for Bermuda is higher taxes, more fees, more regulations, more government intervention which has/will only lead to higher prices, unsustainable economic prospects and crime. Since the government are the largest employer on the island and local free-market competition is minimal in some sectors, there’s no precursor to change this trend.

At some point, the value will be soaked up by the state and Bermuda will have little to offer residents, visitors or hungry entrepreneurs. It will likely remain as a centre for business activity, similar to other offshore centres, but thats about it in my estimation. The fact remains, regardless of how many millions in how many accounts you hold–Bermuda is no longer worth it.

Thank you for reading, be sure to check out our other content & feel free to send in a post anonymously!

#StayOnTheBall

Great article. I’ve been to Bermuda and this all rings true.