Ulta Beauty, Inc. engages in the retail of beauty products. The company has one reportable segment, which includes retail stores, salon services, and e-commerce. Its products include makeup, skin care, tools and brushes, fragrance, and bath and body. Ulta distributes its products through its stores, website, and mobile applications. Ulta was founded on January 9, 1990, and is headquartered in Bolingbrook, IL, USA.

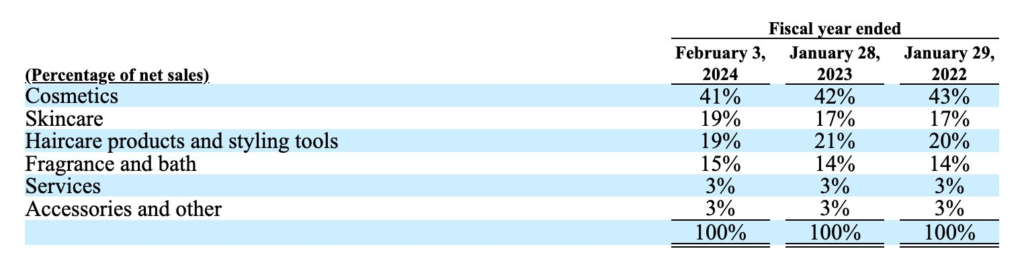

Products

Ulta utilizes a loyalty program which is used by more than 42.2 million active members. Here, they offer discounts & cashback offers which makes Ulta’s business somewhat sticky, even for a shopping population that is contracting.

They hold 1,350 stores nationwide in the United States and have a partnership with Target that hosts their products in over 500 stores as well. Their model is similar to big Costco, Wal Mart or Target by having a high number of large stores to achieve a high turnover rate to offer lower prices & hold customers.

Free Newsletter

Simply Click The Button Below and Fill in an Email of Yours

Ratios

| Earnings Per Share | $25.64 |

| Price to Earnings | 15.90 |

| Price to Sales Ratio | 2.24 |

| Price to Book Ratio | 10.71 |

| Price to Cash Flow Ratio | 16.98 |

MARKET CAP$18.86B

Fundamentals

58% ROE

20.94% ROA

ROTC: 41.88%

ROIC: 34.49%

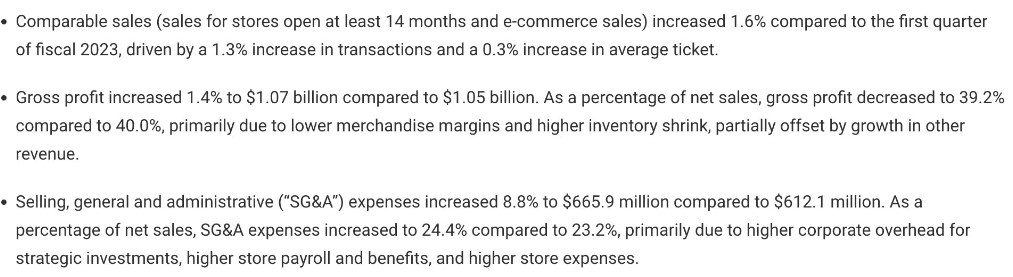

Gross Margin 39.09%

Pretax Margin 15.13%

Operating margin 15%

Net Margin 11.52%

SG&A/Net Sales: 24.54%

Impressive

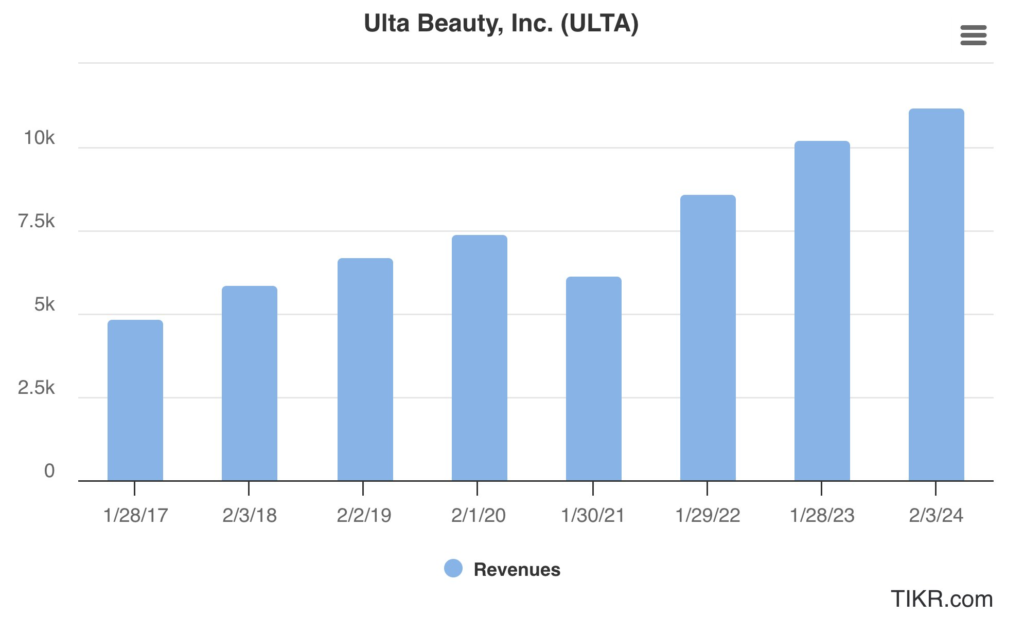

If we look at their Free Cash Flow per share for instance, in 2025 it was $2.29, not 10 years later, it is now $21.10. It’s important to note that they didn’t over leverage themselves in order to hit these growth numbers. In fact, their growth has been in the double digits every year with the exception of 2020, when the world economy shutdown. The numbers are represented in their sales using the same time comparison:

2015 $3.2bn in sales vs. 2024 $11.2bn in sales (so far)

They hold a 11% looking at their 5-year revenue CAGR

Growth is to continuing, so far in 2024 their sales growth is up 9.4%. Asset receivables averages around 200M a quarter.

They also have enough cash flow to buyback 6% of the market cap every year.

At the time of writing (July 2024) Wall Street views the country as having a 20% upside

- SHARES OUTSTANDING47.72M

- PUBLIC FLOAT47.6M (this is after a 30% share issuance reduction over the last 9 years)

Balance Sheet

Net Debt to EBITDA

2022 0.72

2023 0.51

2024 0.49

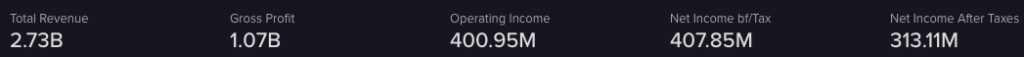

Q2: 2024

Total Liabilities/Total Assets: 59.15%

Total Current Liabilities/Total Current Assets: 56.8%

Cash: 524.6M (making up 9.31% of total assets)

Total Debt: 0 and Net Debt: -524.6M

And it’s up like Nvidia

Just joking…

With this… YTD Returns currently sit at -19%. In fact 3.95% of their float are currently being shorted. A huge opportunity to pick up shares.

Despite their growth in free cash flow, moat, share buybacks, low debt position & solid customer base, SG&A increasing faster than gross profits could have spooked some investors away who think the growth is no more. Regardless, this is set up to continue to pump out free cash flow for investors.

Ownership

Institutions

97.82% (Change 1.82%)

Strategic Entities

0.2% (Change) 25.46%

Others

1.97% (Change-151.66%)

Of the largest shareholders–>

| NAME | TYPE | SHARES | VAL | % |

|---|---|---|---|---|

| The Vanguard Group, Inc. | Ivst Mngr | 5.52M | 2.89B | 11.58% |

| BlackRock Institutional Trust Company, N.A. | Ivst Mngr | 3.14M | 1.64B | 6.58% |

| State Street Global Advisors (US) | Ivst Mngr | 2.21M | 1.16B | 4.63% |

| Geode Capital Management, L.L.C. | Ivst Mngr | 1.16M | 608.56M | 2.44% |

| T. Rowe Price Investment Management, Inc. | Ivst Mngr | 1.03M | 537.27M | 2.15% |

My Favourites

- Significant Share Buy Backs

- Significant Sales/Earnings growth the last 10 years with little sign of slowing

- Ulta is still undervalued at around 15x earnings with no net debt.

- Excellent Asset/Cash position

- It’s trading at a historic low valuation [though expect it to trade lower if VIX continues to rise & the bigs sell off their books].

- Their products are diversified and they hold a market cap double to their competitor in ELF Beauty.

- They hold the lowest number of shares outstanding compared to all of their competitors

Closing

This company may look overwhelming by taking a peek at its share price, but this company has been conservative with their balance sheet where I believe they are ready to withstand the next inevitable recession.

The threats I see are that a major credit contraction may greatly kill their growth prospects and a major sell-off of their shares given their massive institutional ownership (some investors are already predicting with their short positions)

Till now, their amazing growth year to year has enabled them to be in a secure position with strong fundamentals despite the lockdowns and banking uncertainties. They have bought back shares significantly, continue to be in a cash position to continue to do so and remain at healthy ratios.

Furthermore, demand in the beauty industry is relatively stable AND most importantly predictable! People always want to look attractive, which makes cosmetics companies more stable than other in the retail space. Cosmetics are also expensive enough for the companies to turn a profit but affordable enough so the larger public can continue to shop. Some sociological research even shows women will forego home decorations and even furniture in favour of continuing to buy makeup!

Obviously this is not investment advice and everybody ought to do their own research–but it’s worth considering this company for your watchlist!

Do you like write-ups like this? This is what is offered in the Subscription Service . Grab the Discount Today!

Thank you for reading! Please Share!