An Energy Stock That Deserves Your Attention

This stock likely has been missed because it’s only big listing is on the Singaporean Stock Exchange (SGX) and is an Indonesian company. However, if you’re bullish coal, bullish value stocks and bullish Southeast Asia as a region… continue reading.

But first, please consider joining our Free newsletter!

Company

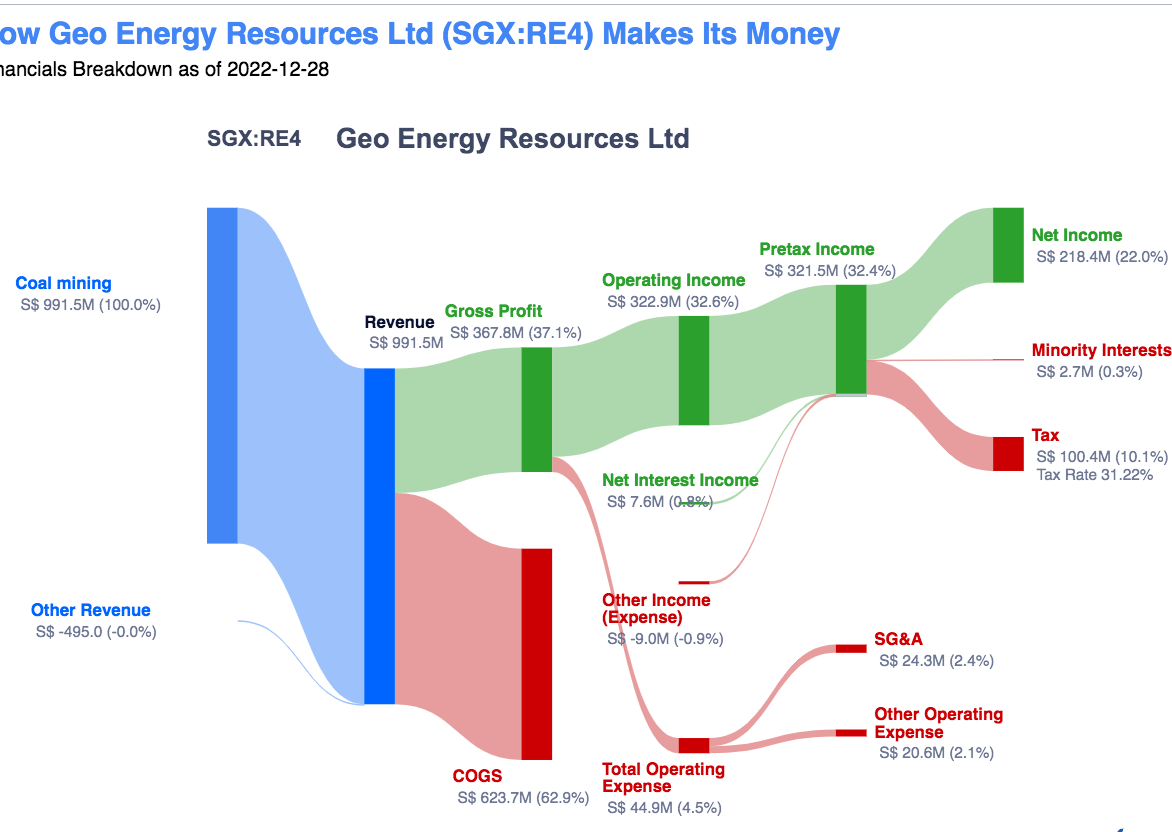

Geo Energy Resources, Inc. ($RE4) is a coal mining group established in 2008 with offices in Jakarta and Singapore. Their operations are in Kalimantan, Indonesia. They are primarily a coal mining services provider to a coal producer that subcontracts its coal mining operations. This allows them to be a low-cost coal producer with high-quality coal mining assets and to establish world-class business partners in this sector. It owns 4 mining concessions through it’s wholly-owned subsidiaries. They have been public since 2012 & now remains as the only coal producer on the SGX exchange.

It has 204 Employees.

Resources

Two of their mining locations have favourable mining & geological conditions (thin layers of overburden and thick coal seams). They have sub-bituminous, low-ash and low-suplhur coal with an average stripping ratio of 3.5 and less (par for large mining operations). Of the other two concessions, one is operational and the other seeking cooperation with parties to develop the mine. Their mining method is open-pit.

Geo Energy also contract equipment out to miners and trade coal directly to and from third parties.

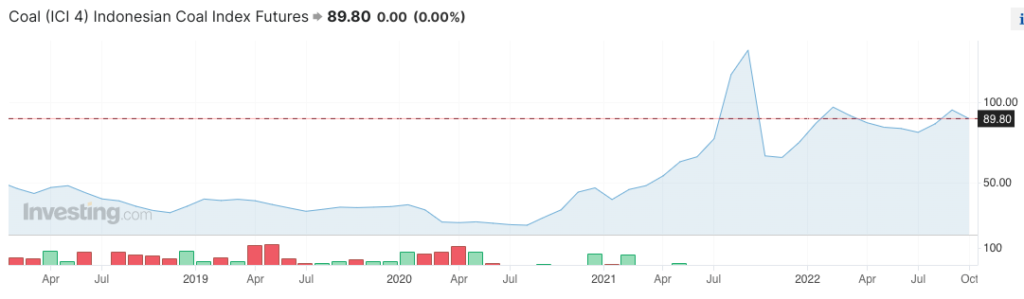

Their coal yields about 4200kcal/kg which is about 43% weaker than their market competitors. Although, if we assume the $90/t (Singaporean Dollar) is sold, Indonesian coal is cheaper than South African and Newcastle coal on a tonnage basis by 88% and 436%, respectively.

1/4th of coal is sold by $RE4 is between $70-90 per tonne domestically with the remaining exported according to the Indonesian Coal Index (which is now trading between $31-115 depending on the quality). This should be considered however as the company has a Domestic Market Obligation of 25% increasing to 30% at a capped $38/t. Though, this hasn’t impacted their operations a great deal.

Every month so far in 2023, Geo Energy have traded above $75/t

Performance

Price performance has been trash…but that is why I’m eagerly writing this to you (to consider getting in now!) For the last 5 years, 1 year and 6M the stock has been down 8.3%, 45% and 29%, respectively. Since, it’s just moved sideways.

52-Week Range (S$)–>0.21-0.42 (currently 0.29)

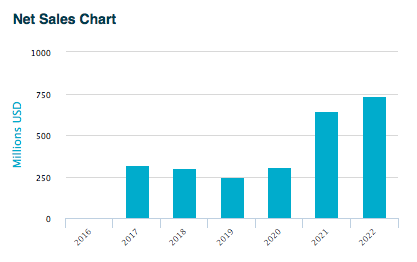

- Coal sales amounted to 5.2 million sales

They’re able to keep their operating expenses a mere fraction of gross profits.

As of March 2023, they were paying a steady 29.5% dividend yield. This has been since cut however as sales have subsided, now down to an annual dividend of 0.06 SGD of 26% yield (0.01 SGD paid in September 2023). It’s chairman said this month (September 2023) that it’s new acquisition allows it to get back to paying a reliable dividend.

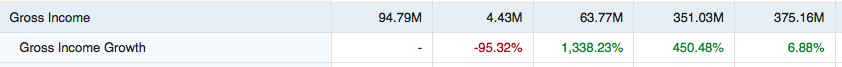

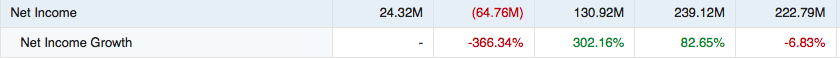

With respect to income, it has reliably outperformed expenses notwithstanding a coal export ban by the Indonesian government

Their pay-out-ratio on 2022 net earnings is equivalent to a 57.0%

Six months into 2023 the Net profit is down 74% down to a profit of 27.1M, revenues have also declined ~35% to just below 240M.

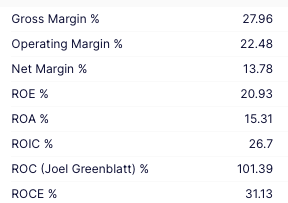

Ratios

At the time of writing (Sept 2023):

Total Liabilities/Total Equity = 30.5%

Total Current Assets/Total Assets = 55.3%

P/E = 2.0 (Peer average = 9.2X)

P/B = 0.70

P/S= 0.51

EPS = 0.08 (SGD)

Quick Ratio= 2.52

Price to Projected FCF= 0.24

Market Cap= 307M (SGD)

All very positive numbers with low ratios

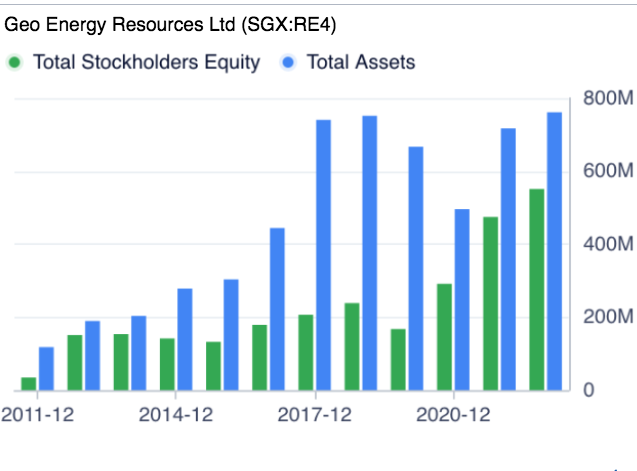

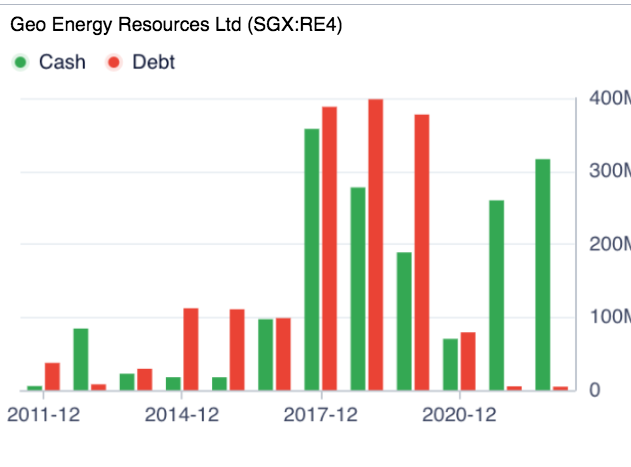

Balance Sheet

Current Assets: 390.06M (2021)/ 454.44M (2022) –378.37M (Q2)

Total Assets: 708.74M (2021)/ 755.13M (2022) –683.67M (Q2)

Current Liabilities: 211.79M (2021)/ 181.92M (2022) –129.02M (Q2)

Long Term Debt: 4.54M (2021)/ 4.06M (2022) –10.44M (Q2)

Total Liabilities: 238.09M (2021)/207.54M (2022) –159.21M (Q2)

Total Liabilites/ Total Assets: 23.32% (Q2 2023)

Shareholder equity hasn’t been this high, neither have their assets.

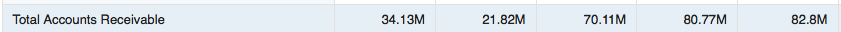

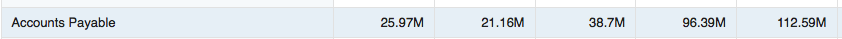

It was noticeable that Accounts receivable was smaller than Accounts payable the last 2 years & the last 2 quarters

Last two quarters: Accounts Receivable–> 93.54M & 69.93M (Q1 & Q2 2023)

Accounts Payable–> 124.59M & 120.88M (Q1 & Q2, 2023)

However, at the end of the day it hasn’t impacted their bottom line.

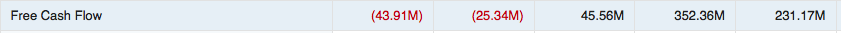

Cash Flow

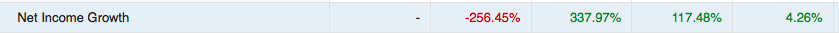

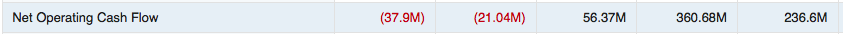

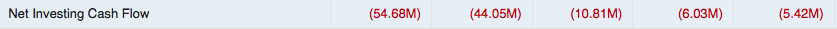

Lots of net income growth the past 5 years, from operating cash flow, paying down short-term debts and left with free cash flow. However, Q1 and Q2 of 2023 had negative operating cash flow of -23.9M and -10.96M with Q2 paying down over 60M of debt. It’s hurt the stock price, but look at their position below moving forward:

Their cash position remains quite large. After two quarters of contraction it’s still 202M SGD in the bank which is an amazing 65.5% of their market cap. This puts their Cash to Debt ratio at 15.29 and their Debt-to Equity at a tiny 0.03

I look at zombies in the NYSE with absolute piles of debt and then I see this that pays a large dividend. Who’s taking more risk?

News

As of July 26th 2023, Geo Energy Group have initiated into a sale/purchase agreement for a controlling equity stake (initial 33%) of an Indonesian Stock Exchange listed coal mining group with over 300 million tonnes of total proven AND probable reserves in South Sumatra (Indonesia). This stake is considered ready-for-development infrastructure to supplement existing performance of the coal mining group with an option to increase stake up to 58.70%. Collectively the reserves are expected to provide over 20 years of production. This subsidiary holding will involve a 10% tax to be paid to Singapore however, which will eat into profits slightly.

This also comes at a time when the Monetary Authority of Singapore is discussing financing an early-phase out of coal-fired plants in the region. Sure, this could raise concerns about Geo Energy but I view it as a guarantee that no new coal producers will emerge in the region to compete and the Chairman of the company assured Indonesian banks have no quarrel with continuing to work with them.

The Chairman of the company conceded that coal favourably is on a decline and after their coal mines life reaches expiry will look to diversify into other energies–but doesn’t see that day anytime soon. Which brings me to the big picture:

UPDATE: Geo Energy Resources’ COO and CFO buy 660,000 shares at 30 cents apiece (it’s 0.295 SGD now). Neither of them held shares until this move. In a separate filing, Lu King Seng, an independent director of the company, bought 100,000 shares from the market at $30,500 or 30.5 cents each

Big Picture

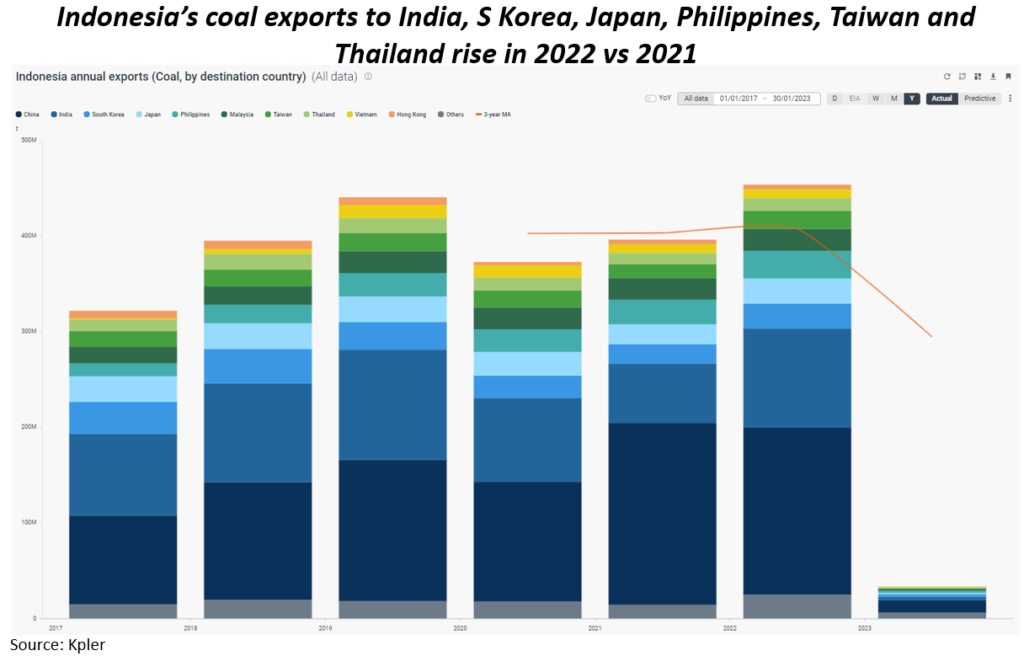

Coal continues to be the largest and cheapest energy source globally and plays a vital role in balancing the energy supply shortage amidst ongoing Russia-Ukraine war and supply chain disruptions. Coal remains 60% of the energy throughout Asia-Pacific. It is not going to phased out in 24 months because some bureaucrats sign some papers. Countries in the region are not slowing their purchases of this energy source. India and China consume large amounts from Geo Energy. The buyers are:

- Thailand

- India

- Indonesia

- Philippines

- Vietnam

- Cambodia

- China

It’s difficult to see according to each country, but note the trend of the increase (2023 data is yet to be finished). 10 million tonnes should be expected (7.5 Mt export sales, 2.5 Mt DMO).

No doubt why the stock has fallen so much is due to the severe contractions seen with China, higher operating costs, halts on exports in 2022 and consequently reduced operating cash flow. Perhaps more pain is to be felt in the stock still as it doesn’t seem like big institutional investors are wise to the extent of trouble with China. Long-term however, the region wants (let me rephrase, needs) energy and I believe it will gobble up this supply given it’s competitive price benefits. If history is any guide, you’re not going to stop a country like Vietnam just cause it’s a rainy day in China. But lucky for you, you’re not investing in a stock price, you’re investing in a coal company and how’s coal doing in Indonesia?

Setting records.

2023 would be a new record, as 2022 was the previous record (663 now 695M tonnes)(remember there was an export ban in 2022, too). The Indonesia economy has also been a large economic player in the region since they are a major coal exporter in the region.

The whole industry of Coal has many companies with low valuations. Couple this with higher net operating costs (although RE4 is hardly impacted), some restrictions as of late, skeptical capital expenditure (for buybacks and expansion of mining assets) & skepticism for investors to go shopping for equities with an inverted yield curve may explain it’s current position in markets–but I view this as a gifting opportunity

I want to leave you with a couple paragraphs found in a manuscript titled: Indonesian Coal Exports: Dynamic Panel Analysis Approach found in the International Journal of Energy Economics and Policy (Ambya & Hamzah, 2022)

They analyzed Indonesian coal exports against list of economic measures from 2015-2019.

The volume of Indonesian coal exports increased with the increase in coal prices in the destination country. The greater the difference between prices in the international market and domestic prices will cause the number of commodities to be exported to increase.

The exchange rate had a negative and significant effect on the volume of coal exports. This means that the greater the exchange rate of the export destination country against the US dollar, the greater the volume of exports.

The foreign trade of a country was determined by the demand of the trading partner country which depends on the income of the trading partner country. The decline in the exchange rate of the rupiah against foreign currencies (US$) allows exporters to offer goods at lower prices, there by increasing competitiveness abroad. The increase in competitiveness will encourage an increase in export income.

If you believe that coal price will increase, that foreign governments will be on the hunt for US dollars and the Rupiah will continue to lose power against the US dollar than this should all mean more sales/profits for Geo Energy Resources.

Side note: If you think ESG is a scam (or at least a wicked misallocation of resources), you may also like $RE4 because from what I can tell they put their heads down and get to work rather than offering sweetened non-sensical presentations on ‘sustainability’ to comply with their ESG overlords (purely anecdotal).

Closing

I’ll close by saying this stock is an interesting play for

- Those with a longer-term time horizon as coal continues to be a dominant form of energy in Asia-Pacific for bargain prices.

- A diversifier by utilizing the Singaporean Stock Exchange to find Indonesian companies

- Dividends. Paying between 22-29% annually

- Stability; this company has loads of cash, lots of operating cash flow and a great Altman score. There’s no signs of financial trouble despite being mandated to support the domestic economy.

- Those who are bullish on Indonesia (taking some of the market share that China once had). In particular, Indonesian exports because of weakening fiat currencies around the world (against the dollar)

- Value investors. Check the multiples.

This stock is piled with cash, current assets, is pumping out free cash flow with very little debt & insiders are jumping in right now. I suspect that it will continue to keep the dividends going to keep investors happy, too.

Do you have a better stock in mind? Don’t just tell me… tell the world. Click this link to submit your own article! Make my ideas heard

If you have charts, tables, screenshots or photos email [email protected] and I’ll make sure they are in your post, too. We’re looking forward to hearing from you!

Join others and Subscribe for more content like this!

#StayOnTheBall