Which Economy? The Banking One or the Real One?

I was catching up with a friend recently who is still situated in what I like to call Canazuela the other day. He was enthused to inform me that the Bank of Canada had decided to drop the CBDC, or Digital Dollar project that they had been working on previously. I thought it was clickbait at first until I realized that it did begin to sound like good news. Perhaps it is true and Canazuela is rounding the corner. However, since the last 3-5 years my suspicions and distrust of government has, let’s just say, been put in overdrive.

I believe that the Bank of Canada is likely to collapse a few commercial banks (TD with their immense 3B dollar fine for money laundering drug proceeds and BMO with their overextended commercial loans and lack of returns on loans) to centralize power yet again. In doing so, a crisis environment could give rise to the claimed “need” of something called a Digidollar. This usage would operate whereby transactions are facilitated through the clearing system of the Central Bank. In effect, it would be a CBDC, but it would not have the “name” of a CBDC that so many have rightfully condemned.

I wanted to start this point off by tying it to other points that the Central Banks, namely the Federal Reserve, play a considerable role in the economy that we know it. This deceitfulness is very dangerous as it fundamentally improves and streamlines our life; but at the cost of individual autonomy, personal freedom and free markets.

Before Reading On, Please Grab Our Email Newsletter

Join the Exclusive Subscribers, too

In late 2020 I recall seeing from Hedge Funds that they were saying the stock market is totally detached from the economy itself–and at the time of writing, that is an understatement. Weekly, there are scary announcements, indicators, charts and correlations surrounding the health of the global economy–but the markets continue to shine green everyday.

The ‘MAG-7’ have truly carried the other 493 companies to new heights despite concerns on jobs, global war and rising conflicts, credit card and fiscal debts, lack of political confidence, inflation, interest rate risks and demand constraints for oil.

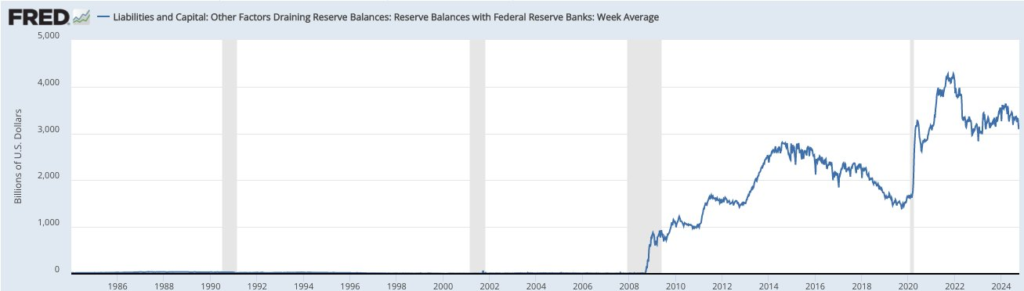

Although, I wanted to write less about the stock market and more about the parallel centralized economy forming from the Federal Reserve. I’ve previously wrote about how the Reverse Repo market has been a home for the huge amounts of leftover cash from the Covid hysteria/spending spree that the banks had on their balance sheet–which never made it onto debt markets at all. After all, why risk buying treasuries when you can risk free park your cash at the Fed for similar yields? There is a whole other component of channels that can be bailed out in perpetuity that happens behind the scenes.

Banking used to be when you would deposit your gold coins at a bank and receive notes (or claims) on that amount of gold which were interchangeable to your gold when you returned to the bank. Savings and chequing accounts were completely different with the former paying you an incentive interest for storing with them and the latter enabling you to write cheques against the gold deposit. Now, they call them that, but in reality your deposits are nothing more than liabilities on the banks’ balance sheet. Furthermore, since all transactions are digital now, they are far easier to regulate but more importantly, to circulate. They are coming and going by a microsecond, all over the world, all the time; exponentially circulating the amount of money supply available and thus, the risk of any given one not having enough cash to meet its liabilities. That is, until cracks begin to form.

Wizard of Oz behind the scenes

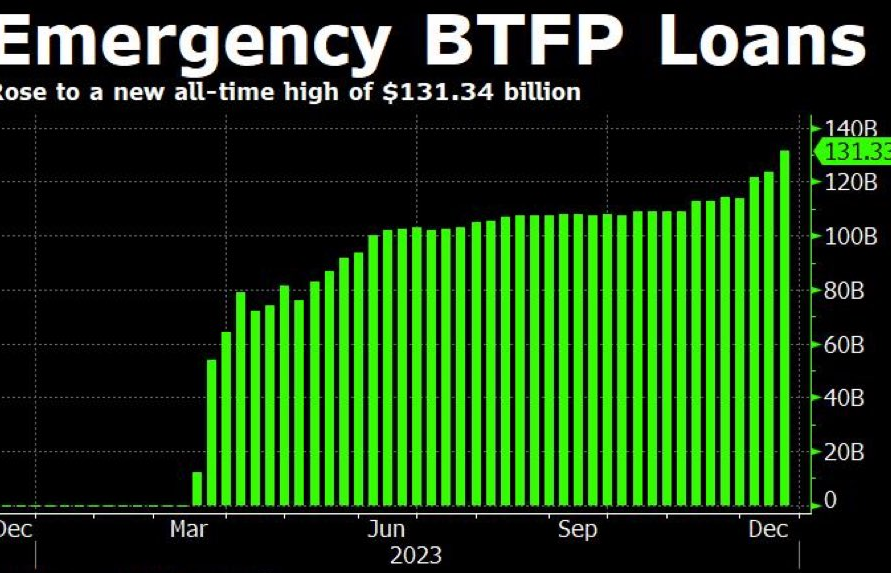

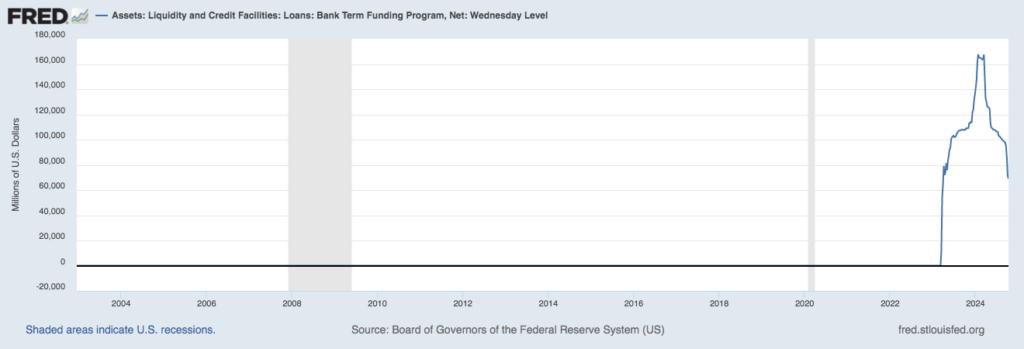

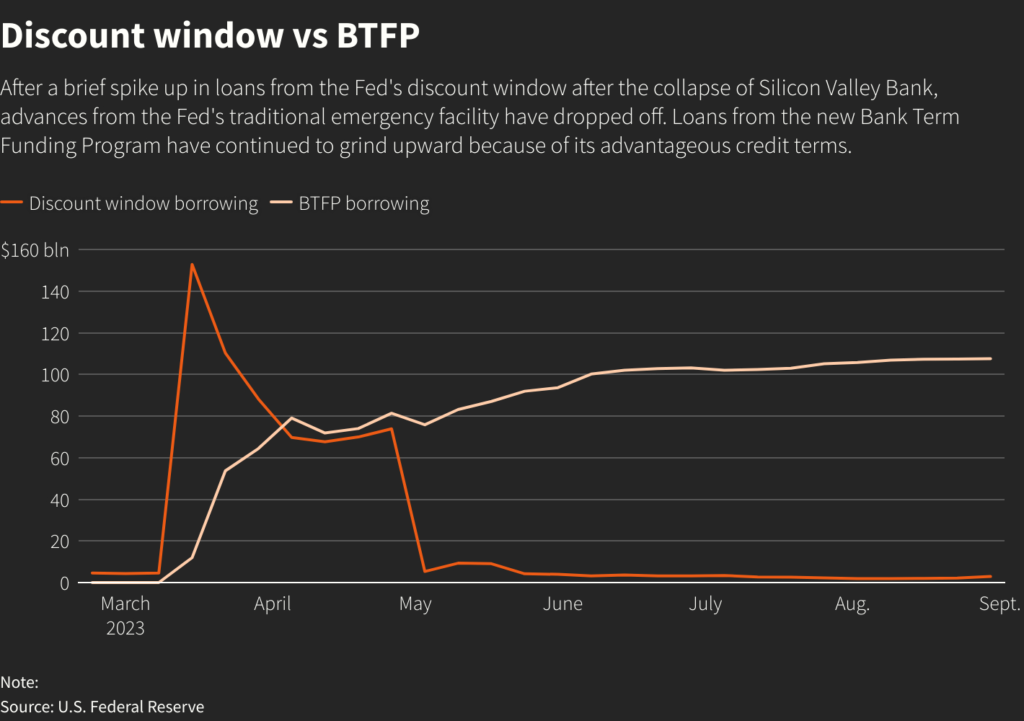

A new facility at the Federal Reserve known as the Bank Term Funding Program (BTFP); which is yet another bailout regime at the Federal Reserve has reached an all time high since it’s initiative in March ($131.3B USD). Banks with access to this facility can draw upon it and deposit at the Federal Reserve in Repo markets for a yield at-or-near debt market yield rates.

Central Economy? We Don’t Have That in the United States!

Then why are so many storing their reserves with the Central Bank?

To support American businesses and households, the Federal Reserve Board on March 13, 2023, announced it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral

Please Click the Link Below to See How Many Facilities There are Active

https://www.federalreserve.gov/funding-credit-liquidity-and-loan-facilities.htm

What you’re seeing is absolutely nothing available from 2003 but all of a sudden in 2023, to sustain the crumbling companies due to corporate credit debts and a weakening global recession, a literal bailing out of the economy with Bank Term Funding.

It’s Laughable When People Say USA is a Free Market

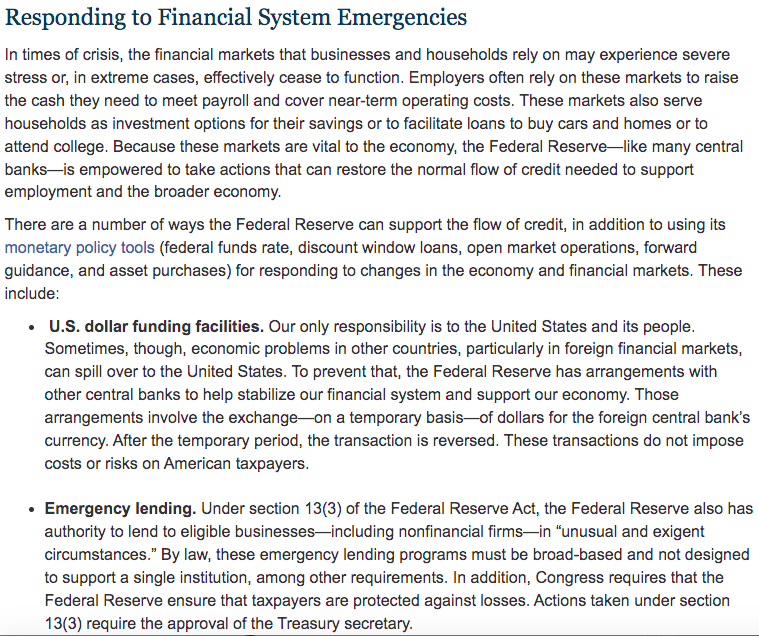

Straight from their website at the Federal Reserve; they have two mechanisms to flow free money to banks, money managers, businesses, even households! Effectively, it’s print more money to pay for the old money till infinite, as long as people continue to believe in that money.

Every Crisis, The Fed Owns More and More

Following every crisis, the expansion of the Federal Reserves’ balance sheet means that they radically expand the asset side of their balance sheet as well. Imagine if you could create money out of thin air to buy things–after awhile, you’d have trillions of dollars worth of assets, too.

Media Spinning it

“Silicon Valley Bank went belly up and nearly set off a national banking crisis, still-growing borrowing from a Federal Reserve emergency lending facility gives the appearance of lingering trouble for the financial sector–but the growth of loan demands more likely arises from opportunistic money management strategies some banks may be employing” —Do you think requiring a bailout screams "opportunity"?

What’s more is that if we look at the BTFP, borrowing via the program mostly represents longer-term loans taken out at its onset. Silicon Valley Bank was an opportunity to kick the can down the road the furthest possible for some who are crippled.

Sneaky

Some banks and institutions are able to withdraw from the Federal Reserve without declaring whether its due to trouble or growth. The Federal Home Loan Bank for instance can remain anonymous so we are unsure whether the new fresh loans are going towards good loans, such as further mortgages for a raging hot economy–or because they are simply failing as a bank themselves. This is what makes this so precarious; it’s like black ice where we cannot see the true state of the situation until we interact with it ourselves.

What Happens if the Fed Stops?

Put simply, it can’t

The absence of continued support causes the system to overheat with debt and liability obligations whereby the Feds presence is required at all times. The big picture is that money creation, since 2008, but truly present now, is never going to stop.

Shadow Banking

I have to refer you to the Rebel Capitalist and George Gammon who does very great breakdowns of what’s really going on in the global monetary system. Long video! All credit to George and his team!

The two points I wish to make are

A) There is a detaching economy that relies on ever-more credit to be issued by the Federal Reserve and an ever-lessening amount of involvement with the goods & services economy (you and I). As I write here, we don’t really matter in this economy, it functions whether we exist or not. Joe or Jane in the real economy never has to enter the equation of receiving overnight Fed rates nor do they have access to easy credit. The banks & those closest to the firehose of new reserves, loans and facilities are protected first and the economic distortions that they created are left for everyone else below this top-down structure to figure out on their own. In a dark humour sort of light, this usefully presents itself as “Why are Groceries so expensive now?”. Since we are forced to play fair in the “real economy” of selling goods and services, than we are fundamentally disadvantaged. The world is bifurcating on these lines as well. While Azerbaijan exports natural gas, the United States exports treasury debt.

B) Given that the economy is running on fumes, the need for a continually injection of support is very real & unsustainable. The US economy broke in 2008 and has been reliant on centralized governance ever since with the Federal Reserve consolidating more and more power month by month. This is a ponzi scheme and admittedly, I have no idea when it will fall (100T in debt? At that point it would resemble the Venezuelan bolivar perhaps).

Either debts will surmount to a point where they are un-payable and the corporate world will overdose on “support” to centralize the entire economy (see how that worked out for the Soviet Union), or losses will go where they deserve to be and the US economy will have to set the clocks back about 60 years from now after such wealth destruction. Either way, not good.

Closing

The involvement with Central Banks in Western economies is growing ever more. The lurking CBDC technology coupled with the corporate suspension makes me believe that the Western economies will resemble something Karl Marx could only have dreamed about.

This is why the national deficit has accelerated as of 2008, 2020 and recent years–it needs more and more currency units to keep the system alive. As you read this, it’s receiving that credit via the Federal Reserve under the guise of economic stimulation. Of course, if you’re close to the firehose of money printed, life is good. It is literally getting something for nothing for you. But all this spending and indefinite bailout has an expense or a cost, and that cost is the destruction of the global reserve currency and the world’s gift of receiving financial support to artificially prosper. So long as the world continues to accept the funding facilitates, so long will the Central Banks continue to gain more and more power and influence. We’ll be praying for a chance to have a “real” economy once again.