Money always finds a better home

For anyone adept to knowing the dangers of socialism, social justice, big government, big brother bureaucracies and centralized economies it should come as no shock that Canada, otherwise known by myself as Canazuela, is failing.

It’s failing on all fronts but financially the country is in a precarious position. Two years ago the Bank of International Settlements (BIS) released a report examining the likelihood of a banking crisis in countries around the world. They had five criteria of early-warning indicators; household debt: income, private credit to GDP gap, property price gap, foreign currency (investment/capital flows) to GDP, total debt service (DSR): income ratio

If one of the countries were to “trip” just one of these early warning indicators, than there would be a 50% risk of a banking crisis within 3 years. The likelihood of a banking crisis at any given time, in any given country is about 7% (earthquake, big losses, war, etc.). But, according to the BIS, guess who trips 4/5?

Canazuela does!

and this was two years ago. One year left, Canada.

Finance Tip

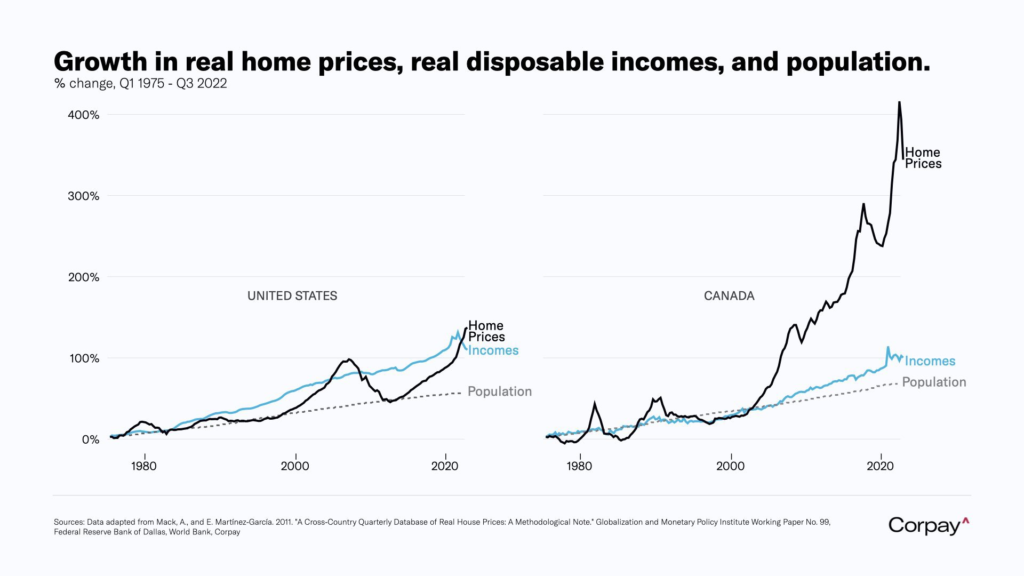

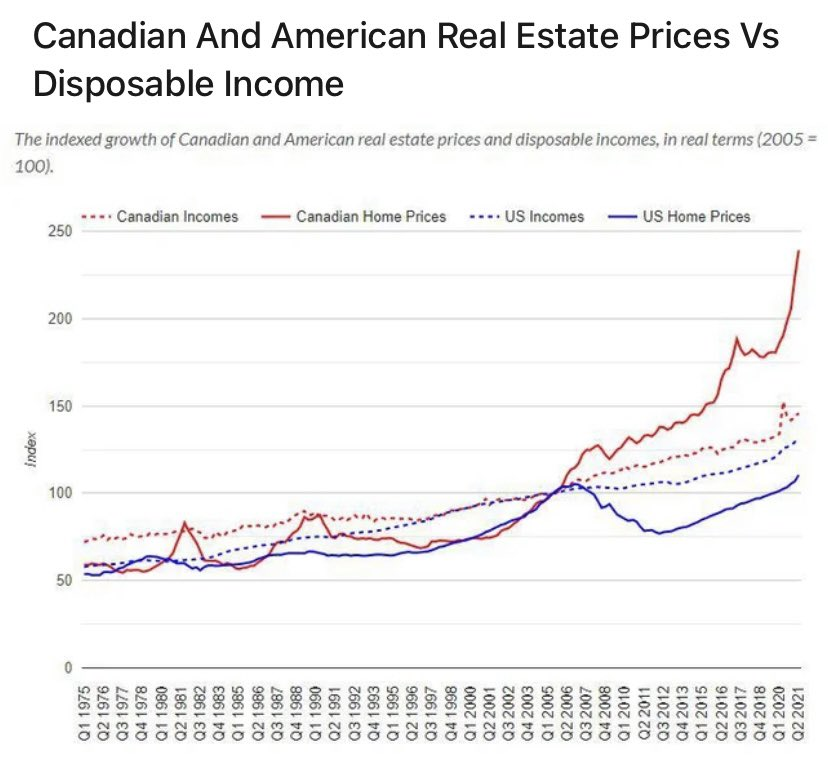

An interesting take away is that there’s more threat in a quick (negative) change to the metrics rather than absurd numbers. In other words, if borrowing ramps up all of a sudden, it is a worse indicator than if borrowing is normally high, but unchanged. It is based upon the relative recent history compared to where you are right now–Canada’s credit expansion, home prices and household debts have been wicked. In fact, I know somebody who is now receiving 10s of thousands of dollars from NINJA (no income; no job) loans right now.

On all relevant economic metrics, Canada has fallen exactly from 2015 (what happened then?) and is currently losing business to Mexico at an accelerating rate. Canada is no longer a trusted jurisdiction to do business from a tax, bureaucratic, and political perspective.

A whole stream of money printed up by the Bank of Canada, borrowed and spent by the Trudeau regime trying to find its way, inevitably lands into assets that are bad. These assets won’t perform or will ultimately default. If you’ve been paying attention, the country has been the poster child for funding things that are uneconomic and as you’d expect… investors get out (or decide not to enter) while the going is good.

Canada has resorted to killing people to keep the pension alive

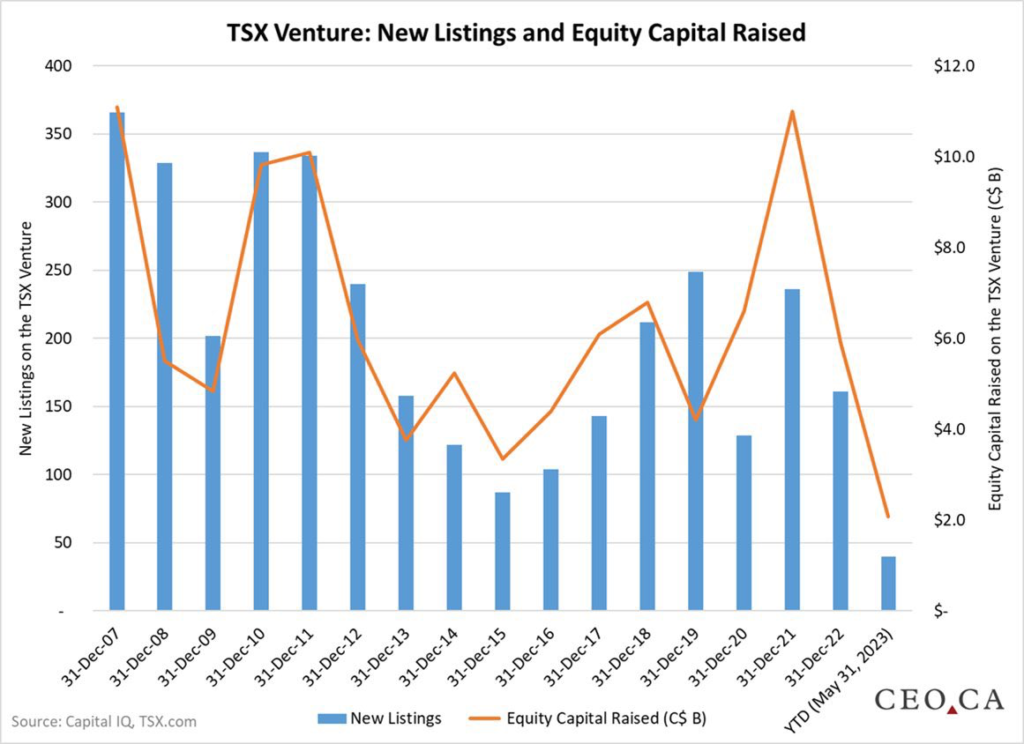

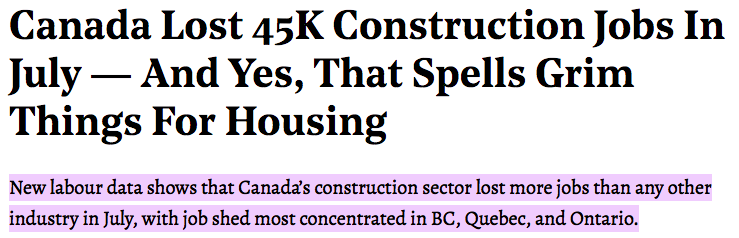

Take a look at the markets. This goes back to the Great Financial Crisis where venture capital was hardly deterred. Now, there’s a nose dive of investments into venture companies in Canada and a bottom in the number of new listings. The same trend is seen in Canadian real estate where sellers are forced to take large equity losses.

The Exodus Nobody is Talking About

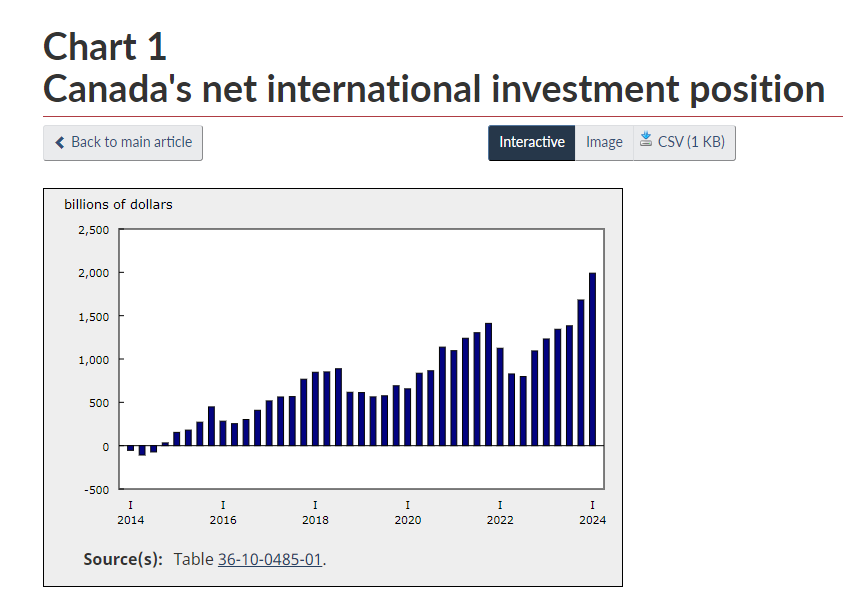

From 2001 to 2014, Canada took in billions and billions of more foreign investment from the United States. In fact, Canada’s banking and real estate sector stomached the Great Financial Crisis a lot better than the USA economy. Businesses, large and small, bank accounts, brokerage accounts and company formations were headed North on net.

However, this changed in 2015. Quickly and constantly, over the course of the next decade, Canadian businesses, investors, entrepreneurs, and professionals started taking their money out of Canada, and moving it to the United States and abroad.

If we look at around 2022, $1 trillion dollars in book value had left Canada for the USA (and a net value of about $460 billion dollars). Compared against the population of Canada, that is $11,500 per person, a number than almost covers all of provincial debt per person in Canada. The number grew in 2023, equalling about $12,500 per person a year later.

What the heck does this mean? This capital translates to jobs for Canadians, potentially much higher wages, housing, start-ups, better roads and infrastructure, more hospital staff, research, maintained machines, mining contracts, etc. Countries that are healthy do not have this occurring, this is a sign of a dying economy before your very eyes.

This is not new, but Bills and Amendments to Investment Acts are new

The first formal rejection of a transaction (outside the cultural sector) under the Act occurred in 2008 in relation to a bid by US-based Alliant Techsystems Inc. to acquire MacDonald Dettwiler and Associates Ltd, a Canadian aerospace company.

In 2010, a preliminary rejection under the Act resulted in Australia-based BHP Billiton abandoning its bid for Potash Corporation of Saskatchewan.

A year later, the effort by the London Stock Exchange to merge with TMX, the operator of the Toronto Stock Exchange failed as well.

The 2012 proposed acquisitions by CNOOC (a Chinese state-owned enterprise) of Nexen and by Petronas (a Malaysian state-owned enterprise) of Progress Energy served as catalysts for changes to the way foreign state-owned enterprises (SOEs) are treated under the Act.

These cases were noteworthy over the last few years, but recently there have been plenty of such cases where bureaucracy and lawfare has constantly kept foreign capital out from entering the country. A number of transactions have been blocked on the basis of “national security concerns”, or they have been withdrawn in the face of ongoing national security reviews

New Changes

On 22 March 2024, Bill C-34 received royal assent, becoming the National Security Review of Investments Modernization Act, adding to the list of potential concerns of foreign direct investments. Bill C-34 represents the most significant amendment to the Act since the introduction of national security provisions in 2009. While the majority of Bill C-34 is expected to come into force shortly, some aspects are not expected to come into force until 2025

- the establishment of a new Canadian business by a non-Canadian is merely notifiable and not subject to approval. All state-controlled businesses, with the exception of “culture businesses” are rejected.

- In some cases, the approval of the investment based on a ‘net benefit to Canada’ test is required. The Act also provides for the review of foreign investments that may be injurious to national security (and people with no business experience get to decide whether it's beneficial or not).

- The creation of relevant legislation and administering entities–> more bureaucracy and red tape.

- Acquisitions of control of Canadian businesses (whether or not already foreign controlled) by non-Canadians, whether direct or indirect, are, at a minimum, subject to notification under the Act. Direct and certain indirect acquisitions of control by non-Canadians of Canadian businesses that exceed specified monetary thresholds are ‘reviewable’, meaning that they require the approval of the ISED Minister or the Cultural Minister. In other words, if there’s significant amounts of capital, something that would be a net benefit to the country, it is reviewable and scrutinized.

- Pursuant to amendments contained in Bill C-34, certain acquisitions, in whole or in part, of an entity carrying on all or any part of its operations in Canada, that has a place of operations in Canada, persons employed in Canada or assets in Canada, will be subject to a pre-closing, suspensory notification under the Act.

- State-Owned Enterprise investments may be deemed subject to net-benefit review where the GIC determines the review of the investment to be in the public interest, regardless of whether a review is otherwise required under the Act. More discretion of an ignoramus bureaucrat

I am not a lawyer, and in so far I understand law, it’s difficult to untangle the cobwebs of Canadian law. Needless to say, the power of state is immense as every single action, small or big (in fact, the bigger ones are more likely to be treated with rejection) bounces around on a number of desks before any ownership or transfer of assets is possible.

Spooked Away

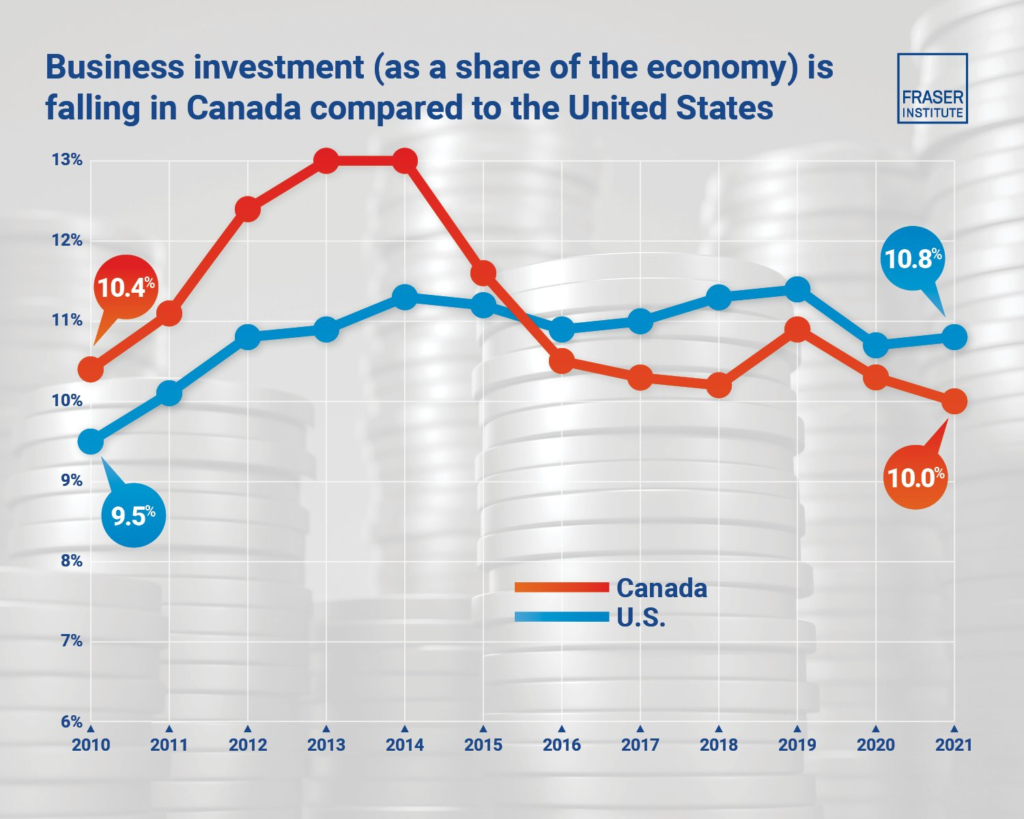

Under Trudeau, Canada‘s business investment since 2014 has dropped 21%. The USA, it increased 33%. “Canada‘s weak economic growth & low productivity constitute a national crisis

Capital always goes where it’s treated best and it’s abundantly clear that Canada is not the ideal option. Why I do not say the ideal option “right now” or “at the moment”? Well it’s because there’s nothing turning the ship around; full speed ahead into stupidity and a financial crisis. The foundation is no longer supportive for long-term investment growth.

Investors like assets outside of the country better

If you’re living in Canada, I hope your main takeaway and understand is that this is not reversing. This is the trend, the country will head over the waterfall and bring about an immensity of problems that you and certainly your children have never experienced.

If you’re interested in learning about how you can relocate and reduce living costs (radically), reduce taxes (legally) and improve personal liberty (in a massive way), than contact us here! We’ve launched a subsidiary dedicated for assisting individuals who say enough is enough and wish to make some changes to their incomes, taxes, freedom and residency.

It’s the 11th hour, Canucks.

#StayOnTheBall