If you can’t figure it out, can they?

It’s been remarked throughout the years that given the inherent instability of the place, Africa is a great place for a young man to make his fortune. Go in, get rich, get out. I am bullish on resource companies on the continent and with some exceptions I believe Africa will be drawn upon for an abundance of metals and energy resources in the near future. Although for sake of the article, I’m referring about opportunities that extend beyond a 5% portfolio holding or backing up the truck on Barrick Gold. I’m referring to All-in company ideas that you want turning a million dollars revenue a year with an established headquarters and employees.

Teasing with this idea, I’ve came with two business proposals. I wrote a string of lawyers or prominent people across 3 countries and it has simply fell flat. Now it’s entirely possible my ideas just…sucked. However I’ve had a chat with a friend of mine recently who did more than write compelling letters, he actually went to the continent.

He did so because he learned of a deal signed between Zambia and the Democratic Republic of the Congo on minerals–and wanted to find out the real nitty-gritty details. He left with his tail between his legs after finding out that they were in reality far from implementation. He did come away with another speculation (not grounds for investment or business formation), but his Zambia idea–flat.

The countries that I had contacted were Cabo Verde, Namibia and Botswana (+ Zambia from my friend), are all on the upper side as far as African economies go–the most normal of abnormal if you will. I’m writing an article now highlighting why Mauritius, the most developed and sophisticated of the African countries are conclusively doomed. They are walking lockstep with Klaus Schwab’s Great Reset agenda. You’ll own nothing and be happy, now East Ze bugs. So, forget about it there.

Seychelles have been neck-and-neck with Mauritius for this title of being the best in Africa. Seychelles are well designed for the offshore company world, great for vacation and they have drastically improved all aspects of their country across the last 10 years (more on this in the months to come, too) but their issue is twofold from what I can tell. One, due to current drug trade routes, a lot of heroin gets dropped off on those islands which explains why over 10% of their population are said to be dependent on the drug, which doesn’t scream economic boom (how busy can you be on heroin?).

Secondly, anyone who has been to Seychelles has said the same thing–It’s expensive. I think Seychelles is still interesting for companies, foundations, trusts, tax savings, perhaps banking but the price tag is too high to begin for a young man to earn his fortune.

On my call with a regarded lawyer in Namibia, he suggested that my goals were best found elsewhere. When I asked where he sees opportunity on the continent he immediately said Ghana and after the fact mentioned Burundi could be something.

Click my article here on Ghana to read there.

What about Burundi? Let’s just look at 4 things.

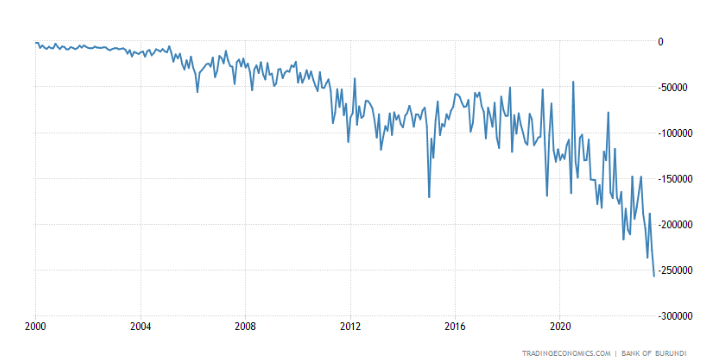

- Balance of Trade

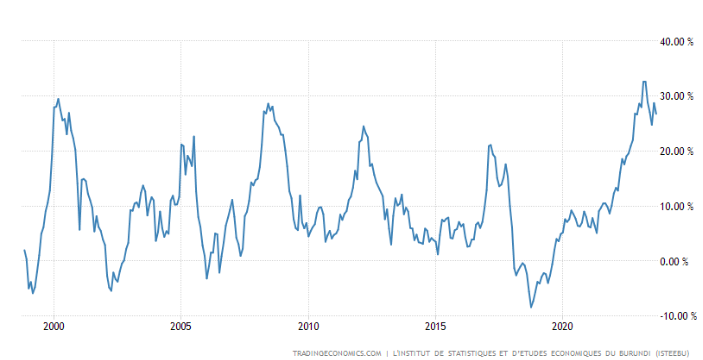

2. Inflation Rate

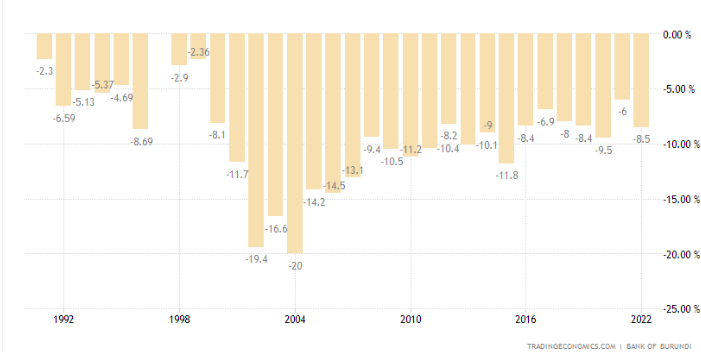

3. Government Budget

4) Highly skilled employees earn–> 74 USD a month (around 900 USD a year)

Interestingly it does have low corruption with a low debt to GDP but Burundi has an economy of 3 Billion and only 0.03 tonnes of gold. You’re talking about a nation that banned jogging, is classified as having water scarcity with the 2nd largest lake (by volume) in the world and a place with two capital cities.

Northern Africa looks interesting for a vacation but it’s no different in terms of its functionality as the rest of the continent. Without even going too deep into it, one must question why so many young Algerian, Tunisian and Moroccan men are so eager to get to Europe if there are meaningful opportunities at home. Over 30% of all the newly crowned Spanish citizens as of late were born in Morocco–to quote Jonah from Tonga “But sir, there’s heaps of them!”. Aside from the Iberian World Cup of 2030, I can’t see any business friendly upsides.

The economic powerhouse of the continent in South Africa (check my Platinum article) is pretty well a lost cause at this point. I’ve spoken to some successful South African gentlemen who articulated it nicely by putting it: “Yee, it’s gone to shit”.

The number 2 largest economy in Nigeria has been a list of revolts regarding the forced CBDC method there and locking people from receiving their cash (they deposit cash in, they receive digital slave records called e-naira in return). In late 2022, Nigeria’s Foreign Direct Investment touched negative for the first time in over 33 years. Despite their immense oil (almost 90% of their exports are mineral fuels, oil) and some redeeming qualities, it’s not a business savvy hub by any stretch. As the 12th largest oil reserves in the world, Europe (as a continent) still refines 43:1 barrels of oil more than Nigeria. From what I can tell, their fintech scene has ended up in a bunch of scams. To be politically incorrect for a moment, it seems like the rest of African countries have problems with Nigerians.

There’s Egypt, who are hurting so much with their dollar-denominated debts they started charging train passengers to pay strictly using dollars (locally they use the Egyptian pound). Not a good sign. Plus once they get those dollars they pretty well have to spend them because they are extremely dependent on grain imports.

Kenya, a large agricultural producer is interesting, with a very suppressed stock market but they rank 20th in the world for the most number of terrorist attacks.

I could go over more countries but I beg the question to proponents of the Africa is the place to be for making wealth notion. Where and by doing what?

I suppose this is literally a million dollar question. Although it doesn’t seem clear that Africa is stable, business-friendly, tax friendly, healthy enough nor does it have the foundations for growth in any field, anywhere.

Perhaps like my prior two ideas, maybe this idea of “nothing is stable enough”…is wrong. Although, I think a larger point can be drawn upon for an international investor. If you are reading this & are puzzled by the question, and my friend and I have put some thought into it and come up short–

What are the odds that locals who are imbedded in the corruption, violence and chaos who have far less money, education and connections have the answer? Or put differently, what’s the likelihood that the locals will make the proper changes to create an environment that is stable enough?

I hope to inspire wiser minds than I to find the answer and walk away with their riches while I highlight some difficulties faced by locals. Things always get better may be a phenomenon that has yet to make its way across the pond.

#StayOnTheBall