Company

WISMILAK INTI MAKMUR TBK.

PT Wismilak Inti Makmur Tbk, commonly known as Wismilak is a holding company, which engages in the manufacture and sale of cigarette flavoring, filter rods, and other cigarette parts. Its products include hand-rolled and machine rolled cigarette, and cigars. It operates through its Cigarette, Marketing and Distribution segments.

The company was founded on December 14, 1994 and is headquartered in Surabaya, Indonesia.

I began writing this at 585 IDR which equates to 3.6 US cents per share but we’ve received a nice bump recently

| Mkt cap | 1.78T (107M USD) |

Gross Margin 26.16%

Operating Margin 12.66%

Pretax Margin 13.02%

Net Margin 10.14%

Balance Sheet

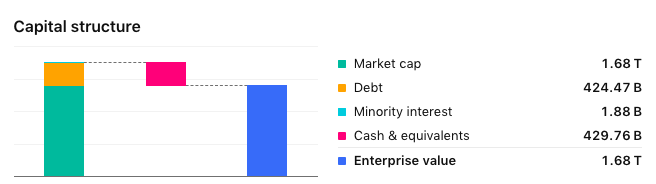

Trading fairly, and cash equivalents can eat all the debt tomorrow if it needs to do so

As of December ’24 (in IDR)

Total Current Assets: 2.47T

Total Assets: 3.03T

Total Current Liabilities: 1.01T

Total Liabilities: 1.11T

~33% Total Liabilities to Total Assets

A high portion of their assets/liabilities are deemed current

RETURNS:

Return on Assets 20.84%

Return on Equity 29.56%

Return on Total Capital 36.41%

Return on Invested Capital 29.53%

A nice little bump in price

Their Website: https://www.wismilak.com

Speaking of Website: SECURE yours today with Website Policies. Follow the link below https://www.websitepolicies.com/?in=809

Ratios

P/E: 5.59

The P/E often sits around a cool 6-7 with it touching 11.41 in 2023 for one quarter and 12.94 for an annual reading in 2019

P/S: 0.31

EPS: 125 IDR (approximately: 0.01)

Price-to-Book ratio is 0.68

Current Ratio: 3.08

Quick Ratio: 0.82

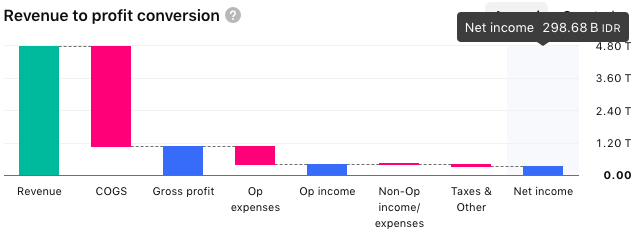

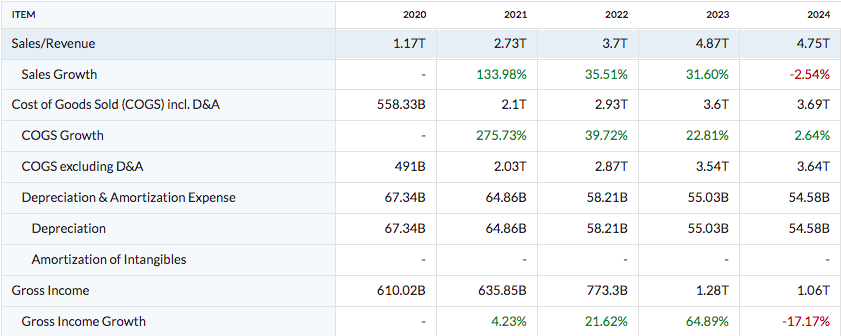

Income

494.31 B IDR –> 30,118,854 USD

4.87 T IDR (or 297M USD)

504.09B <–Accounts Payable (Dec ’24)

127.76B <–Accounts Receivable

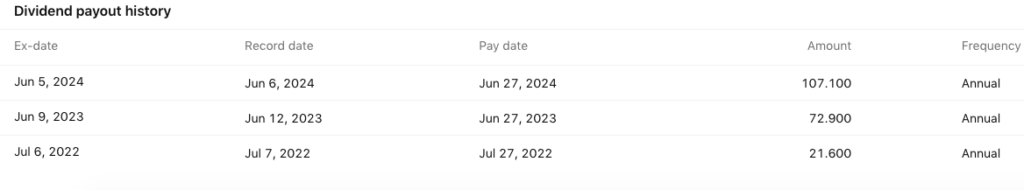

Dividend

We’re now looking at an enormous 18% dividend yield for last year. Even if this pulls back considerably due to reduced cash flows, it would be above anything you’ll receive in growth stocks on the Nasdaq.

Not only this but this dividend has been raising every year.

Problems

Currency Risk

Year over year the Rupiah has seen a pull back of 5% against the dollar, not great, not terrible. However it is a rather volatile currency with a constant inflationary trend going against them as they export more and more product to the world.

Volume

Another problem with the currency is the illiquid nature of it. At the time of checking, volume is only 314,400. You’re not going to be trading with this company.

Indonesia has seen tremendous growth as of late in their manufacturing, tourism and industrial sectors and I believe will continue to be a go-to place for large multinational corps.

Accounts Payable

While their short term cash is immense, especially relative to their total assets, their accounts receivable are only about 25% of their accounts payable and therefore they will have to tap into their cash or rely on cash flows to fund operations/expenses. Perhaps this could do a dent in their dividend at some point or at least put a stop to their dividend raises.

COG and SG&A (not listed) are outpacing revenues

They still have healthy margins at the end of the day–but it’s worth noting this trend. Tobacco is very resilient so may not be cause for concern.

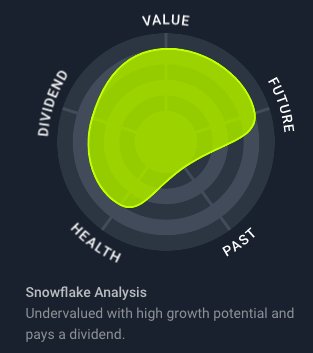

What the Computer says

The moving averages pits this as a hard sell

Meanwhile many oscillators hold this at a sell or neutral rating. One analyst listed it as a ‘Strong Buy’ from what I can tell.

Info

In 2014, they were Indonesia’s 6th largest tobacco company–now they are 4th largest.

Only 1.3% of shares are held by international companies. I suspect this may be due to regulation purposes, but it also means that significant capital has yet to enter this company.

In 2022, their net profits increased by 30% even as the net profits of Indonesia’s largest cigarette companies declined during the same period

Operations are solely throughout Indonesia and hold no other international exposure

Whats the Play

- Value stock with a constant low P/E and P/S.

- Large, increasing dividend

- Growing in revenue and great for somebody bullish in Indonesia OR bullish on Tobacco.

- Very illiquid and small market cap. Not great for huge sums of capital or those who have to receive immediate access to their equity.

- Someone willing to tolerate higher risk of emerging markets

Important Part

For non-residents, accessing the Indonesian stock market can be more challenging. Without a KITAS, it is difficult or even impossible to open a local brokerage account. However, you can still trade Indonesian stocks through an Asian brokerage account based in nearby financial hubs like Singapore or Hong Kong.

Closing

With such a low market cap, low volume, currency risk and almost no economic moat you may suggest that I am crazy for selecting this stock out of the bunch that are out there. However, I think anyone trading Nvidia shares right now is just as crazy and that goes on by the trillions.

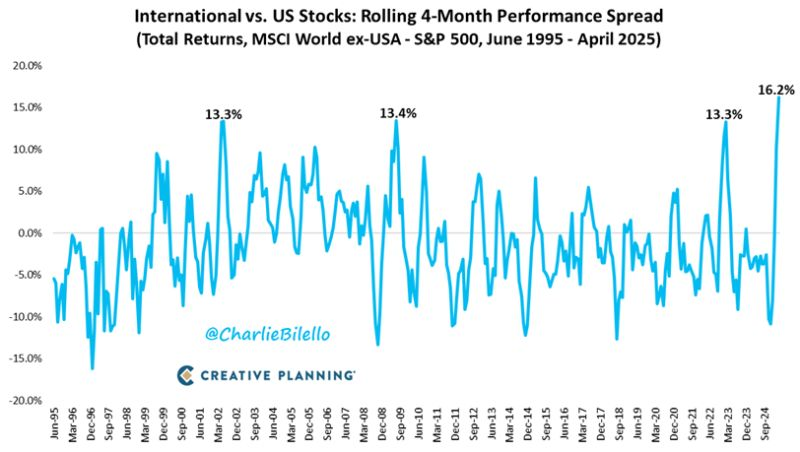

With On The Ball, I seek to bring a contrarian view to the mix of geopolitical newsletters and company picking write-ups. I believe that a rotation will continue into value stocks, commodities and international equities, particularly outside of China.

This company is more than capable of sustaining its debts as it continues to receive enough cash flow from high margins to withstand a high dividend and trades fairly with a significant insider shareholding in it for the long run. China’s love for smoking is going to shut down even if their real estate market does.

It’s not a huge company by any stretch of the imagination, and certainly would require a little bit of patience getting access to handle the inefficiencies of emerging market matters–but nevertheless an interesting play at a time when it’s genuinely confusing on where to best place ones capital for the foreseeable future. Would I go all-in? No, due to the inherent unpredictability of Indonesian lawmakers and geopolitical quagmires–> but there’s few jurisdictions that are all-in-worthy right now unfortunately

Let me know what you think by sending me an email